On trade entry the risk/reward ratio measures a trades potential for loss versus the magnitude of possible profits. In backtesting the average of all the losses in a system compared to all the average gains gives you the system’s risk/reward ratio based on historical price action.

On trade entry the risk/reward ratio measures a trades potential for loss versus the magnitude of possible profits. In backtesting the average of all the losses in a system compared to all the average gains gives you the system’s risk/reward ratio based on historical price action.

Looking at your stop loss versus your profit target for any trade can tell you whether the risk is worth taking the trade. Most trades are only worth taking if you have at least a 1:2 or 1:3 risk to reward ratio based on your plans to manage the trade after entry.

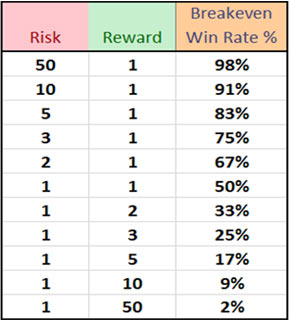

The higher your reward versus your risk, the less your winning percentage has to be to make money.

Your risk is established by the location of your stop loss that will show you that your trade is not going to work out and it is time to exit while a loss is still small.

Your profit target on entry for where you think that price could possibly go if the trade is a winner is where your potential maximum profit is located and can be set to establish the reward in your ratio. You can maximize the potential for capturing a big trend by being flexible and leaving your upside uncapped by using a trailing stop loss to take you out of a winning trade. By only exiting when price reverses you can create bigger winning trades and maximum rewards.

To psychologically create a great risk to reward ratio you need to be very patient with winning trades and give them enough room and opportunity to play out for the most benefit but at the same time have no patience for losing trades and exit the moment you are proven wrong based on price action going where it shouldn’t go if the trade is going to work out in your favor.

Creating good risk/reward ratios with high probability entries through stop losses & letting winners run is the core of all profitable trading.