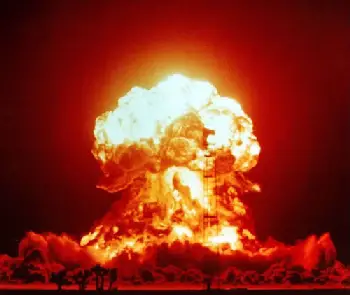

In trading defense is under rated and offense is over rated.Too many new traders want to make money so bad they don’t even consider the risk of loss when the market becomes very volatile and plunges.

Here are ten ways to manage risk and limit your losses during market plunges.

- Your maximum position size on any one should never be more than 10% to 20% of your total trading capital.

- Every trade you make should have a planned stop loss price where you are proven wrong about the trade and must exit.

- Your biggest loss on any one trade should be no more than 1% of your total trading capital based on your position size and your stop loss.

- You should trade with diversified traidng signals: dip buying signals, trend trading signals, and swing trading so you have a chance to make money in multiple types of markets.

- The less your positions are correlated the lower your risk of loss at one time.

- Position size based on volatility not your opinion or ego.

- Trade in the direction of the trend on your time frame.

- Realize bull markets have no long term resistance and bear markets have no long term support and do not get stubborn and hold a position on the wrong side of a trend.

- Also enter a trade understanding the odds that it can be a losing trade.

- You must test any trading system through mutiple types of markets: up trends, down trends, volatile, and crashes to completely understand your risk of ruin.

Risk management can both save you from big losses and eventual ruin during losing streaks. The most valuable lessons you can learn in trading is how to protect the capital you do have to give it a chance to both survive and grow.