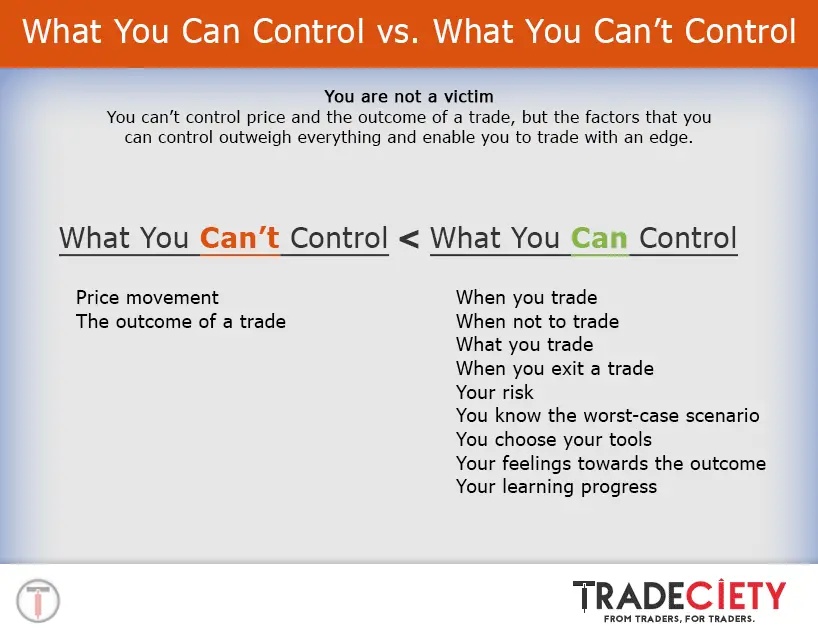

No matter how much a trader believes that they can predict the future, how strong their conviction is, or how much they believe, no individual trader or investor can control the outcome of a market move unless they have enough capital to move a market their self. Traders have the unique frustration that few other careers have, a lack of control on outcome.

A trader can’t control:

- The price movement.

- The outcome of a trade.

Once a trader is in a market the price movement is based on the collective actions of the market participants buying, selling, or holding not their own beliefs, hopes, and opinions. While a trader can manage a trade with size and exit stratagies they can’t control whether their stop loss is triggered for a loss or their profit target is hit for a profit. A trader is at the mercy of the market to choose the fate of each of their trades.

The good news is that a trader does have a lot of control.

A trader can control:

- When they enter a trade.

- When they don’t trade at all but just stay in cash.

- A trader can choose their own watchlist and waht markets they will be trading.

- The price they exit to stop a loss.

- The price target they will exit at to lock in a gain.

- To use a trailing stop loss to let a winner run.

- The position sizing for a trade.

- Plan to manage a maximum loss with the combination of position sizing and a stop loss.

- The technical indicators to use for signals.

- How emotions are managed.

- The lessons you learn from every trade.

- Whether to keep trading or quit.

You can’t control what the market price action will do but you can control what you will do in response to the price action and how each trade plays out after entry. Before you are in a trade you control how big and when you will get in. After you are in you control when and how you will get out. You will never control the markets but you can develop the dicipline to have complete control of yourself.