What is a price action trading strategy?

When you abandon your own opinions and predictions and take a look at what the price action is telling you on the chart is when you go from guessing about the future to trading the present price action. Investors look at balance sheets to buy and sell based on the fundamental valuations of the underlying business. Traders looks at the buyers and sellers locations on the price chart to see what the short term and long term trend of the stock is or where the support and resistance of price is in a trading range.

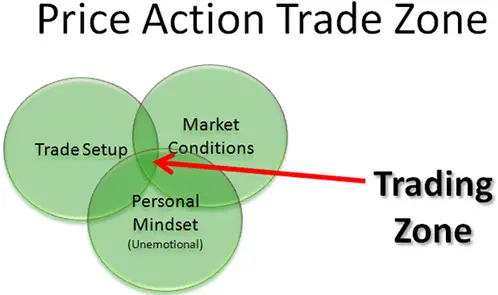

Here are the dynnamics needed to create your own price action trading strategy:

- Backtesting historical price action to see where entries and exits created big wins and small losses in the past.

- You need a watchlist of stocks and markets you have decided to trade.

- Entry signals that tell you when to get in because the probablities of price moving in your favor is statisitcally probable.

- A stop loss tells you where price has to go for the odds of success to shift against you and tell you to get out and take a small loss.

- Positon size so that if your stop loss is triggered you will have a small loss of only a small percent of your total trading capital.

- A price target based on technical levels where price could go if your trade is right. This helps establish your risk:reward ratio on entry. You want to see at least a 1:2 risk/reward to take a trade but a 1:3 risk/reward makes profitable trading much easier from a win percentage perspective.

- A trailing stop will help you maximize wins by not exiting a winning trade until price reverses. Your win may not be the most it could be, but it can keep you in a trade beyond your price target for huge wins during strong trends.

- You need to create a repeatable price action trading strategy with an edge that creates big wins and small losses and keeps you on the right side of the market trend.