This is a Guest Post by Dr. Arnout ter Schure on Twitter @intell_invest.

Are the Advance-Decline Issues Reliable Stock Market Indicators?

A lot has been said about the NYSE Advance-Decline line (NYAD) making new all-time highs (ATHs) recently, and mostly from the perspective that it is clear sailing from here on out because supposedly “breath leads price”. However, a recent paper by Vincent Randazzo, CMT from Lowry’s research pointed out ”While it is often recited in technical analysis circles that ideally, breadth should lead price in healthy uptrends, it is rarely observed. In fact, prior to 2019, there had only been 9 observations of this condition since 1940, when after a drawdown of 10% or more, the NYSE Advance-Decline Line made a new multi-year or all-time high while the major price indexes were comparatively lower“. So, with that myth pretty much debunked, is it also true that with the NYAD making new ATHs it is clear sailing for the Markets?!

Spoiler alert: “No, not so fast!”.

Let’s look at the weekly NYAD chart since the Bull market in 2009 started. I would like to focus on this timeframe as it allows comparing apples to apples because each Bull and Bear has often unique and repeating characteristics. Since that low, there have been at least ten corrections (including the recent May-swoon), some of which up to over 20%, where the weekly NYAD made a new ATH just prior to these corrections (red boxes and grey arrows). There have only been two occasions where the weekly NYAD made a lower high, while the stock markets made a higher high (2015, 2018: red arrows). Each also led to a 15 and 20% correction. Those two occasions were forewarnings.

Based on this simple chart and statistics, it is clear the A/D-line is NOT the magic, one-and-only, will-tell-you-all-you-ever-need-to-know indicator. Did the stock market after each correction continue to make new highs? Sure, it did. But ask yourself: “is sitting through 10-20% corrections [which can be very scary when in it especially without forewarning if one were to rely on this indicator alone] the right way to go?” In my humble opinion certainly not, as it leads to lost opportunity and wasted time.

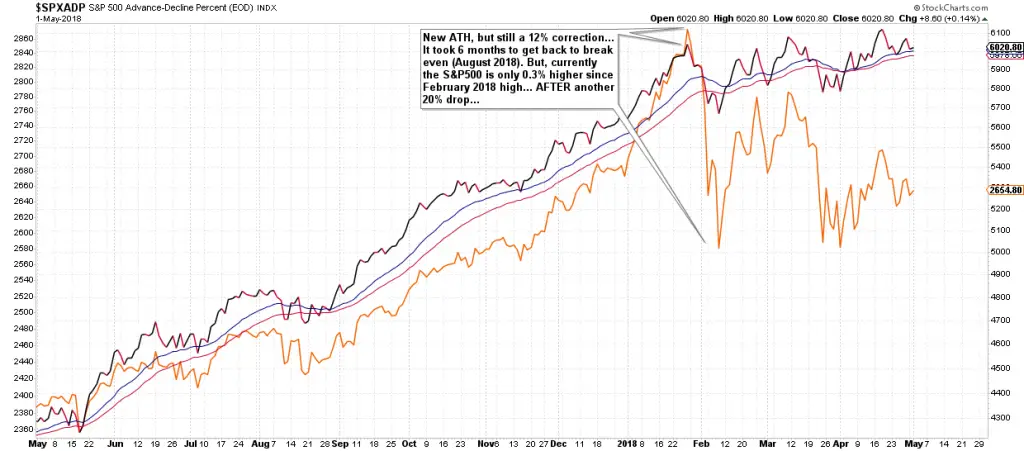

For brevity, let me give two examples using the S&P500 and the SPX A/D line. In January 2018 the AD line made a new ATH as did the index (the NYAD and NYSE did the same btw). But, a 12% correction in less than one month happened. IF one had bought that ATH “because the A/D lines are making new ATHs”, then one would have to wait six months before being back to break even, sit through another 20% correction, and now be up a paltry 0.3% for the S&P500.

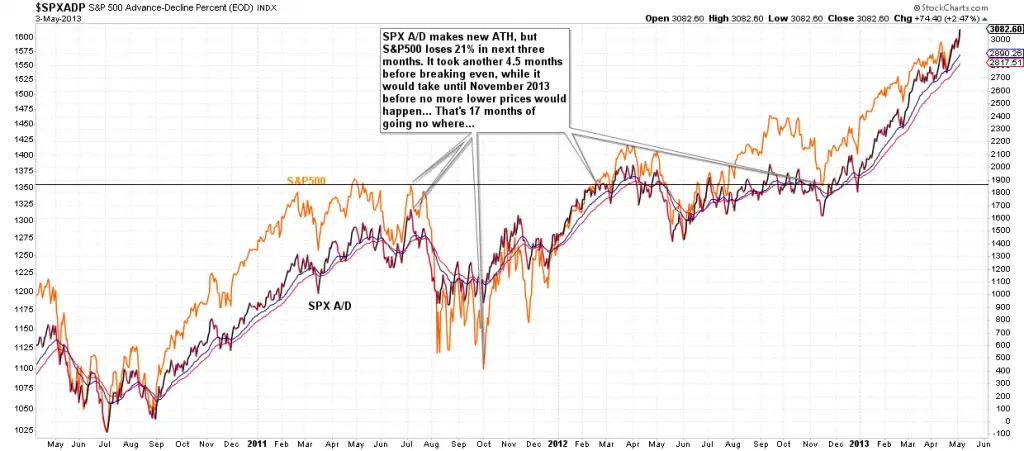

Likewise in 2011. Had one bought the S&P500 based on the SPX A/D (and other AD lines, including the NYAD) making an ATH in July of that year, then you had to sit through a 21% correction first (loss of over 60% when trading the 3x ETFs…) and wait almost one-and-a-half years before getting back to sustained gains. That is clearly not a proper way to trade and invest. That is loss of capital and opportunity.

So, when an indicator can’t help you reliably foretell of a pending 10-20% market correction, it is simple not reliable. In addition, having to wait many, many months before getting back to break even and allow for sustained gains makes its reliability worse.

Thus, just because the NYAD or SPXAD for that matter made an ATH last week doesn’t guarantee its clear sailing from here on out. In fact, with at least ten incidents of failing to foretell of larger corrections over the past 10 years it can very well be this time is no different. That is why I use the weight of the evidence approach in my market analyses. Because using any tool correctly -and not in a vacuum- is important. For example, the Summation Indices (SIs) are still very useful in today’s stock market as they add crucial additional insights on the raw A-D data. Adding moving averages, Elliott Wave Theory and regular technical analysis will only further one’s market insights and increase your odds to be on the right side of the markets.

I hope you will from here on out treat the A/D lines for what they really are: just another tool among many other tools in your tool kit as a successful trader and certainly not the most important one.

Arnout ter Schure, Ph.D.

Founder and President Intelligent Investing, LLC

Vice President NorthPost Partners, LP