This is a Guest Post By Brian Hunt CEO of InvestorPlace.

Amateur investors often bring up a common objection to buying elite dividend-paying businesses. Acting on this objection often leads them into very risky investments.

Most elite dividend payers sport annual dividend yields in the neighborhood of 2%–5%. And these yields are incredibly safe and reliable. They rise every year.

In addition to elite dividend payers, the stock market contains groups of businesses that pay annual yields of 6%… 8%… 10%… even 12%.

The amateur looks at these numbers at says, “Why buy a business that yields 4% when I can buy one that yields 8%?” And then, the amateur makes one of the biggest investment mistakes in the world.

They “chase” yield.

There’s a classic piece of investment wisdom about chasing yield. It goes: “More money has been lost chasing yield than at the barrel of a gun.”

Chasing yield is the act of buying stocks simply because they offer high yields… while ignoring vital business factors.

Some businesses engage in risky business ventures or take on lots of debt in order to pay high yields. Finance and real estate companies often do this.

Some businesses own oil & gas wells and pay dividends from the production. Those dividend payouts are often totally dependent on oil & gas prices staying elevated. They can be incredibly volatile.

These businesses are usually very dangerous for the average investor.

For example, there is a group of companies whose chief business activity is borrowing money at low interest rates… and then using that borrowed money to buy mortgages that pay higher interest rates. They make money from the “spread” between the two.

One of the largest and most popular of these companies is Annaly Capital Management (NYSE:NLY).

Annaly is probably operated by good people. But because it borrows lots of money to buy mortgages, its business — and its dividend yield — is very volatile. Small changes in the business (like how much it has to pay to borrow money) can cause enormous changes in shareholder returns.

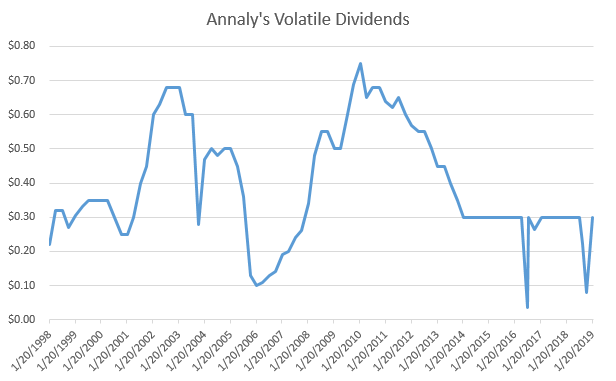

Below is a chart of Annaly’s dividend payments from early 1998 to early 2019. As you can see, these payments are incredibly volatile.

The volatile nature of Annaly’s dividend payment leads to volatile share price movement. Below is a chart of Annaly’s share price during the same time period (early 1998 to early 2019).

The volatility in the early 2000’s and around the 2008 financial crisis is par for the course, given what was going on in the market.

But even after the recovery in 2009 — note the drop from $19 per share to $10 per share.

Or… consider the performance of the San Juan Basin Royalty Trust (NYSE:SJT). Prior to 2014, this trust was one of the biggest most popular trusts that owned natural gas assets.

Then, the price of natural gas dropped around 65%. Because the San Juan Basin Royalty Trust derived its revenue from natural gas, its shares dropped as well. As you can see from the chart below, they fell from $20 to around $4 per share.

Also consider the performance of Enerplus Resources (NYSE:ERF). Years ago, it was one of the biggest and most popular firms that owned oil & gas wells… and paid dividends out of production.

Starting in 2014, crude oil fell from over $100 per barrel to less than $30 per barrel. This decline helped crush Enerplus shares. As you can see, they fell from $25 per share to barely $2 per share.

The examples of Annaly, San Juan Basin, and Enerplus are not unique. And I’m not picking on these particular businesses.

This story plays out over and over in the stock market… with dozens and dozens of companies.

Unsuspecting investors see a company offering a very high yield and they buy it. They don’t do any research to determine if the business model is risky or not. In almost every case, it is.

Some investors are good at timing their purchases of these volatile businesses. They buy them when they are deeply out of favor with most investors.

However, the average investor almost always buys these businesses at the wrong time: near share price peaks. He picks up 8% in dividends and then losses 30% on the share price drop.

The individual investor is much, much better off owning stable businesses that pay out reliable and growing dividends. You don’t trade in and out of elite-dividend payers. There’s no frequent buying and selling. There’s no worry that the share price will fall 30%. There’s no dangerous leverage.

You simply buy them and begin building wealth the low-stress way.

While the dividends and share price of Annaly were bouncing up and down, elite dividend payers like Coca-Cola (NYSE:KO) and McDonald’s (NYSE:MCD) were paying steady and rising dividends.

And that’s easy to spot…if you have a powerful, yet elegant tool at your disposal — like my friend Louis Navellier’s Dividend Grader.

Once you’ve found a solid dividend, without a ton of price volatility…the rest is history.

Regards,

Brian

P.S. At this point, some might ask: “If you want to avoid volatility…why not just buy gold?” Well, let me show you why.

You can see more work by Brian at InvestorPlace.com.