This is a Guest Post by Ivan @Retail_Trading

Understanding fear, overcoming greed and setting rules are one of the things that all traders need to master if they ever want to be profitable and called professional traders. Yes, that goes for you as well.

I am sure that by now, you have already heard that one of the most important things in trading is having a solid foundation, and by foundation I mean your trading system and your trading plan.

If you do not, well you will definitely hear about that in today’s video and read it here.

Having a rule based system is probably one of the most important things when it comes to trading. I said it once, I said it twice, heck I said it so many times and I will definitely keep repeating it because introducing rules to my trading has drastically changed my trading for the better and I believe that if you are just willing to test me on that theory you will be forever grateful for this video.

What a rule based approach to your trading does to your confidence, to your mind, and your emotions is just incredible. Look, when you have an ‘if this’ ‘then that’ process (rule based approach) you are basically just acting like a “robot” in front of the charts, using your eyes to send signals to your brain that the visual interpretation from the market has met all of your rules and that now would be a good time to pull the trigger.

Excuse my geeky explanation but if you think about it, it is exactly like that. After having rules, the only reason why we sit in front of the charts is to see when those rules will be met and to pull the trigger.

See, what this approach to trading does to you is that even when you take a losing trade in the market, you will not be attached to it, because you will know that over a longer period of time that exact rule set that you have applied to the trade will be profitable.

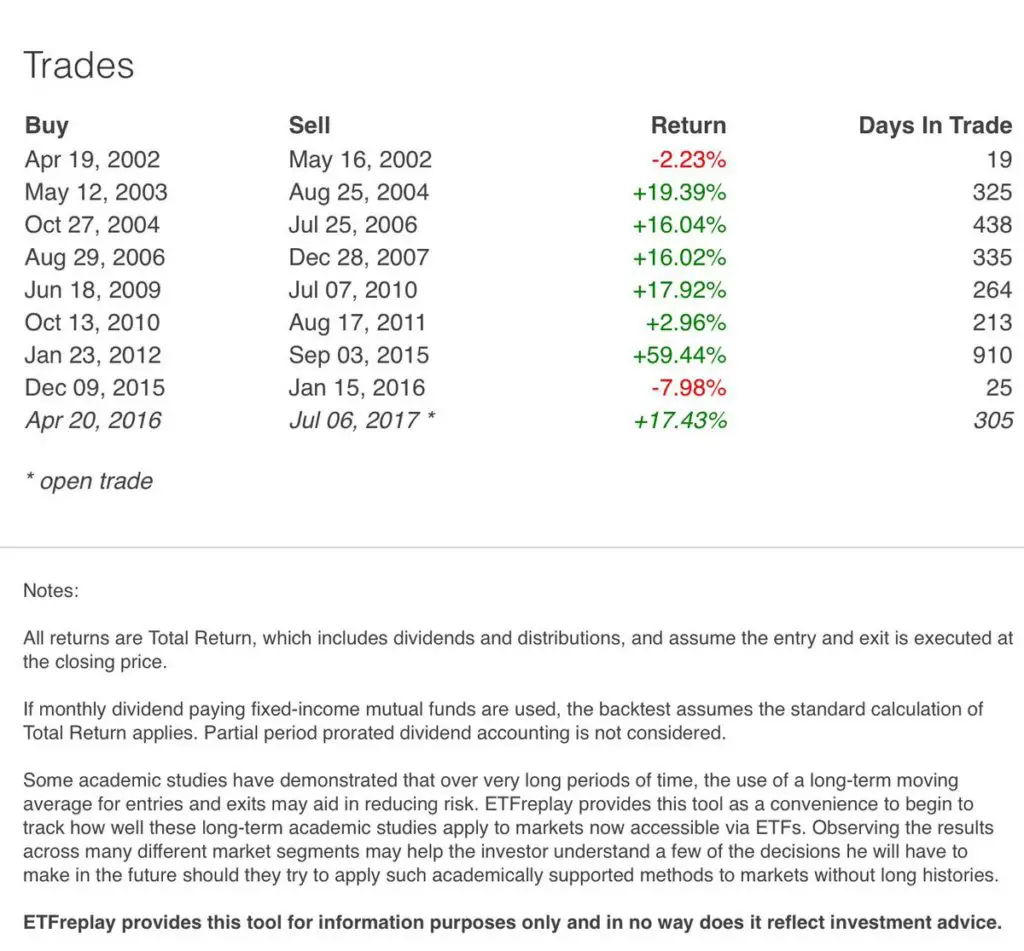

Of course above is correct considering that you are trading a rule set that has showed profitable over your backtesting for a sample period of at least 100 trades. If that theory yields nice returns over the historical data, we trade it live.

If it returned negative results, then I hope you wouldn’t consider trading it live.

Now take an example, a feelings based approach. An approach to trading where you take trades, set targets and stop loss price points based on your feelings.

Let us assume that at some point you took a long position in the market thinking that market will trade higher from that point on. However, the market reversed and hit your stop loss price.

Now, you have found your self in a position where you started doubting your self and thinking, why did I have that feeling, why did I take that trade ? Maybe I shouldn’t have. Maybe I should have waited for some kind of confirmation from the market etc etc etc…

That is called doubt and it is the one of the main reasons 99% of traders fail….

For me not to ruin the video, I’ll have to end the article here and invite you to watch the video.

Follow Ivan on Twitter: https://twitter.com/

Follow Ivan on Instagram: https://www.

Subscribe to his YouTube channel here. https://www.youtube.com/