This is a Guest Post by Luis Hernandez of InvestorPlace.com.

There are so many advantages to investing in dividend stocks.

Ideally, these stocks protect your principal, and allow you to increase your income. Certainly, dividend stocks can provide that.

Businesses that are managed well and growing will generate cash flow that, in turn, can be distributed to shareholders. But as we all know, stocks do not always goi up.

So, when do you sell a dividend stock?

Some investors are so dedicated to their dividend stocks that they will never sell. These investors will hold on because all stocks experience some volatility now and then, and some will even cut their dividend, but all that is part of the ebb and flow of the market.

But for investors who are so focused on the income, knowing when to sell can be tricky. If a stock’s value drops might it just as easily come back? If the dividend is cut, might there still be some upside potential over a longer term?

Luckily, we have an expert who is willing to give us insights to help us make the right decision.

This topic came to mind because Louis Navellier recommended selling a dividend stock in his Growth Investor service. Louis’s track record for double and triple-digit gains in any market conditions is tough to beat. There is a reason The New York Times called him “an icon among growth investors.”

I found this particular call a little surprising because the stock he recommended selling has performed very well recently.

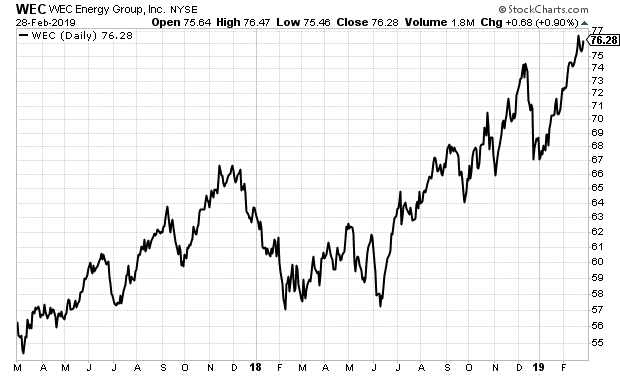

The stock was WEC Energy Group. Below is a chart of its performance over the last 2 years.

WEC provides electricity and natural gas to more than 4 million customers in Illinois, Michigan, Minnesota and Wisconsin. It’s one of the largest energy providers in the United States.

But Louis thinks it’s not the best dividend investment anymore. He described why in a message to his subscribers last month.

We added the stock to the Buy List given its long history of rewarding shareholders, as well as its strong fundamentals. The company has paid a dividend for 132-straight quarters, or 33 years. WEC Energy will pay a quarterly dividend of $0.59 per share on March 1 to all shareholders of record on February 14. This will mark the sixth dividend that we’ve received.

WEC Energy also recently crushed analysts’ earnings estimates for its fourth quarter. The company reported fourth-quarter adjusted earnings per share of $0.71, which topped estimates for $0.64 per share by 10.9%.

However, in light of the company’s deteriorating dividend reliability and the stock’s subsequent downgrade to a D-rating in Dividend Grader, I recommended that we exit the stock. If you purchased WEC at the time of my original recommendation, you sold your shares for about a 15% gain, including dividends. Sell WEC.

Deteriorating dividend reliability certainly seems like a warning sign. Something every dividend investor would want to keep an eye on.

You can get the full story, plus access to all of Louis’s Elite Dividend Stock picks, as part of our Growth Investor service.

But there are other warning signs when you own dividend stocks.

Louis has agreed to let me share with you a few of the warning signs he looks for to determine if a dividend stock is becoming unreliable. If any of the dividend stocks you own meet these criteria below, you should consider whether holding is still the smart play.

Warning Sign #1: Deteriorating Cash Flow

When determining if a company’s dividend is sustainable, the first place you should look is the company’s cash position. Consider both the cash on the company’s balance sheet and its ability to generate cash flow. If a company’s cash flow is deteriorating or it’s taking enormous amounts of debt, its ability to pay a dividend is also deteriorating.

Warning Sign #2: Credit Downgrades

This sign was very characteristic of energy companies back in 2016. We saw several big-name energy stocks like ConocoPhillips (COP), Chevron Corp. (CVX) and Mobil Corp. (XOM) have their credit downgraded by rating agencies, such as Moody’s.

Typically, a credit downgrade precedes a cut in a company’s formal credit rating. Companies do not want this to happen, as a credit rating cut means that they are at risk of higher borrowing costs when they issue new debt. So, when a credit downgrade does happen, companies often slash their dividend to preserve cash flow, as well as its credit rating.

Warning Sign #3: Weak Fundamentals

Earnings announcement season reveals which companies can sustain their corporate buyback programs and dividend payments. You see, when a company has weak fundamentals, it can’t rely on sales growth or earnings growth to improve its cash flow. Instead, it must look at what it can cut to make up the difference and free up cash. The first step is usually to eliminate stock buyback programs and the second step is to cut dividends.

In most cases, it doesn’t matter how many consecutive quarters a company has paid a dividend or how consistently it’s increased the payment over time. Many companies are going to prioritize cash flow first because that’s the way they keep their businesses running.

Warning Sign #4: Suspended Stock Buyback Programs

The low interest rate environment has created a stock buyback frenzy. Corporations are issuing cheap corporate debt to fund aggressive share repurchase programs. This is great news for shareholders because as the pool of outstanding stock shrinks, the remaining shares become more valuable.

However, when a company cuts back or suspends its stock buyback program, it could be a sign of trouble. Specifically, when a company suspends its stock buyback program, it typically means that the company doesn’t have enough cash to support the program or that it’s taken on too much debt to buy stock. And if a company doesn’t have enough cash to support stock buybacks, the dividend is next in line to be cut.

Warning Sign #5: Falling Stock Price, Rising Yield

When a business runs into money problems, it will look for less sustainable ways to support their dividends. For example, a company may cut costs, using cash originally allocated for basic operations or capital investment to fund dividend payments. In other instances, a company may take on more debt or sell shares in order to raise more funds to support dividend payments.

What’s interesting is that when this is happening behind the scenes, the company’s dividend yield is growing more attractive to yield hungry investors. That’s because the dividend yield is rising, as the company’s stock price is falling. But if these investors don’t look under the hood to uncover the real reason for rising dividends, they could be in a heap of trouble when the company ultimately can’t maintain its payouts and cuts the dividend.

Those are some great principles for every dividend investor to keep in mind. Regular income from a dividend stock can be a great benefit, but that doesn’t mean the stock will be the best pick for you forever.

Knowing the signs for when a dividend is in trouble is key to protecting the income you may have come to rely on.

If you’d like to learn more about Louis’s Elite Dividend Payer stock picks, click here.

To a richer life

Luis Hernandez, Managing Editor

and the research team at InvestorPlace.com