This is a guest post by AK of Fallible.

The financial media will tell you that options are more risky than plain vanilla stocks. This is true if we define risk as the volatility of returns. But practitioners will tell you that volatility is a crappy measure of risk.

Other market participants will tell you the opposite. They claim options are far less risky than stocks because your loss is defined. This sounds good on paper, but in practice it’s not too important in an overall risk management system.

Both these viewpoints on option risk are wrong.

Options are neither more or less risky than stocks.

Risk is a function of position sizing, not product type.

Let’s break it down.

As an investor or trader you always want to think of your downside in relation to your account size.

Say you want to buy a call option because you think the price of a stock will go up. You have a $100,000 account. There’s a chance that call option expires worthless and 100% of your invested capital is lost. But you get to choose what that 100% loss means in relation to your account.

If the call costs $1.00 you could bet your whole account and buy 1000 of them. In that case if the option expired worthless, you’d be broke, having lost the 100 grand. Now say you bought only 1 call option for a total of $100 and the option expired worthless. A loss of $100 on a $100,000 account is only a 0.10% loss in total.

So you see the option is not inherently more or less risky than the underlying stock. It just behaves differently. Rather, what makes it risky is the number of calls you buy.

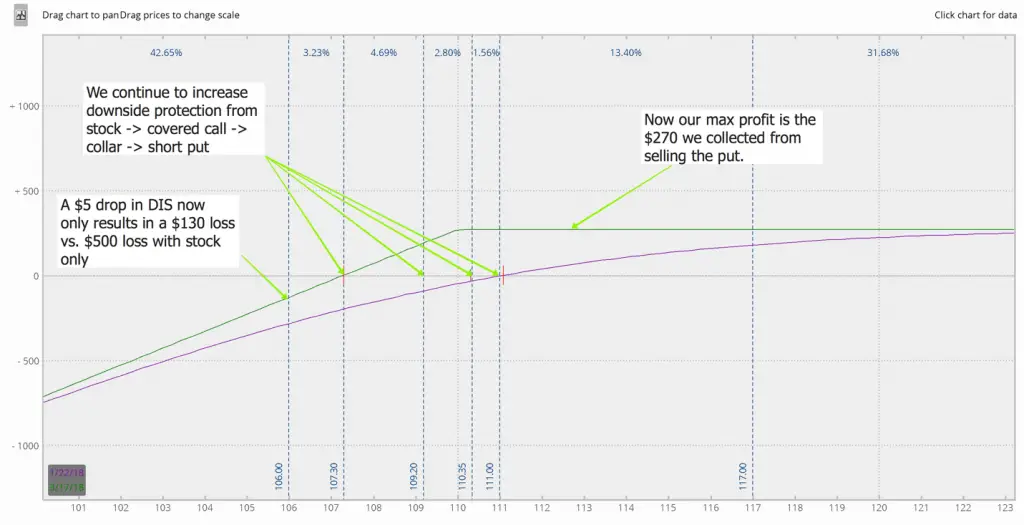

This same argument is also used against sellers of options. Critics say “well if you sell a naked put you have limited upside and unlimited downside. That’s a very risky position.”

Again, the short put is not risky in and of itself. It’s risk depends on how many you sell.

For example, say you had the choice between buying shares of SPY the S&P 500 ETF or selling a put on the ETF.

Let’s say the stock is trading at $206.44 and a 206 put is selling for $4.45.

If you bought 100 shares of the stock, you would spend a total of $20,644. Now imagine the market got knee capped and SPY sold off 50%. You would be sitting on a $10,322 loss.

For more, make sure to watch the video above!

Learn the REAL way to trade options with our free guide: https://macro-ops.com/foptions/

Here’s the full article: https://macro-ops.com/the-misconceptions-and-pitfalls-of-options-trading/

Follow AK Fallible on Twitter: https://twitter.com/akfallible

And Instagram: https://www.instagram.com/fallible_money/

***All content, opinions, and commentary by Fallible is intended for general information and educational purposes only, NOT INVESTMENT ADVICE.