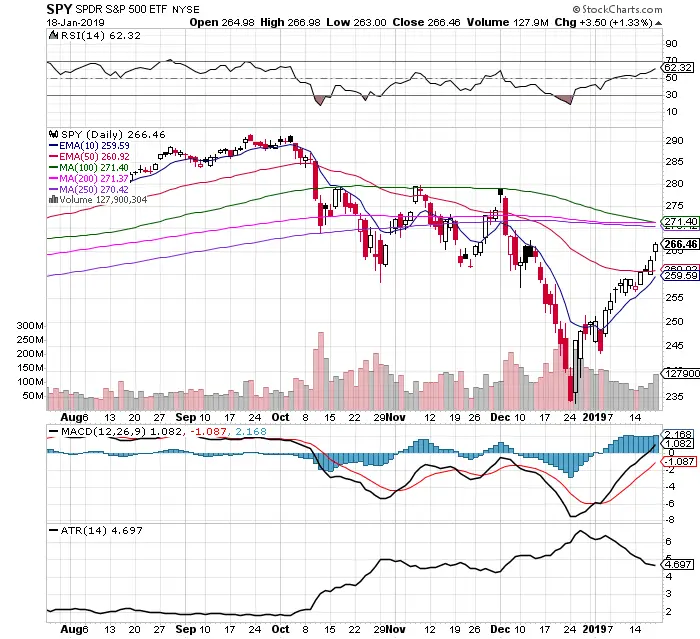

Chart Courtesy of StockCharts.com

- $SPY price is back over all short term moving averages 5 day, 10 day, 20 day and not the 50 day.

- Last week the volume increases on the swing to higher prices.

- The trading range continues to decline as measured by the Average True Range (ATR) at 4.69. This shows a decrease in fear and uncertainty on this short term up swing in price.

- The MACD continues to remain under a bullish crossover. The fast line crossed back over the positive side of the MACD chart for the first time since October.

- The RSI at 62.32 has room to continue higher before becoming overbought.

- $VIX at 17.80 continues to swing lower but remains over the key 200 day SMA long term support.

- The confluence of the 100 day, 200 day, and 250 day SMAs are converging together showing the long term range of the market over the past year.

- The next key resistance levels on the chart will be at the 250 day SMA and the 70 RSI could be at a confluence of signals.

- Currently $SPY is in an up swing from the Christmas Eve lows, a new uptrend signal will trigger if $SPY can close above the 100/200/250 SMAs.

- The market continues to have more bulls signals each day as the up swing continues with sectors and leading stocks showing increasing strength.