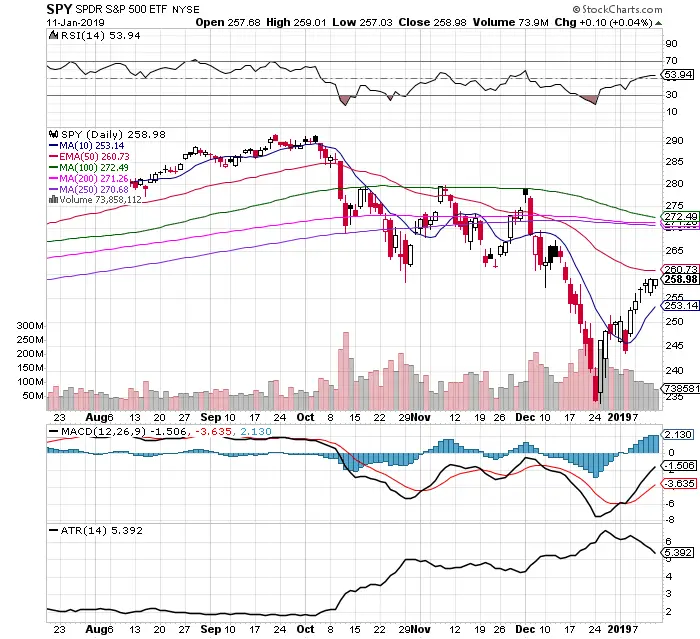

Chart Courtesy of StockCharts.com

- $SPY remains over short term moving averages last week like the 5 day and 10 day EMA.

- $SPY price remains under all key long term moving averages 50/100/200/250.

- $VIX continued to trend lower last week to 18.19 as volatility has been contracting since the day after Christmas.

- The trading range has declined as the ATR has continued to fall to 5.39. This is a bullish signal.

- The MACD continues to maintain a bullish crossover.

- $SPY continued to show momentum by staying over the 50 RSI side of the chart last week to end at 53.94.

- The uptrend swing higher since December 26th has been on low and declining volume.

- There remains a lot of cash on the sidelines after the volume to the downside from the Q4 2018 sell off.

- Short term trend is up, the long term trend remains down.

- My long signals for $SPY would be a 10 day / 50 day EMA crossover and/or the price crossing 250 day SMA crossover.