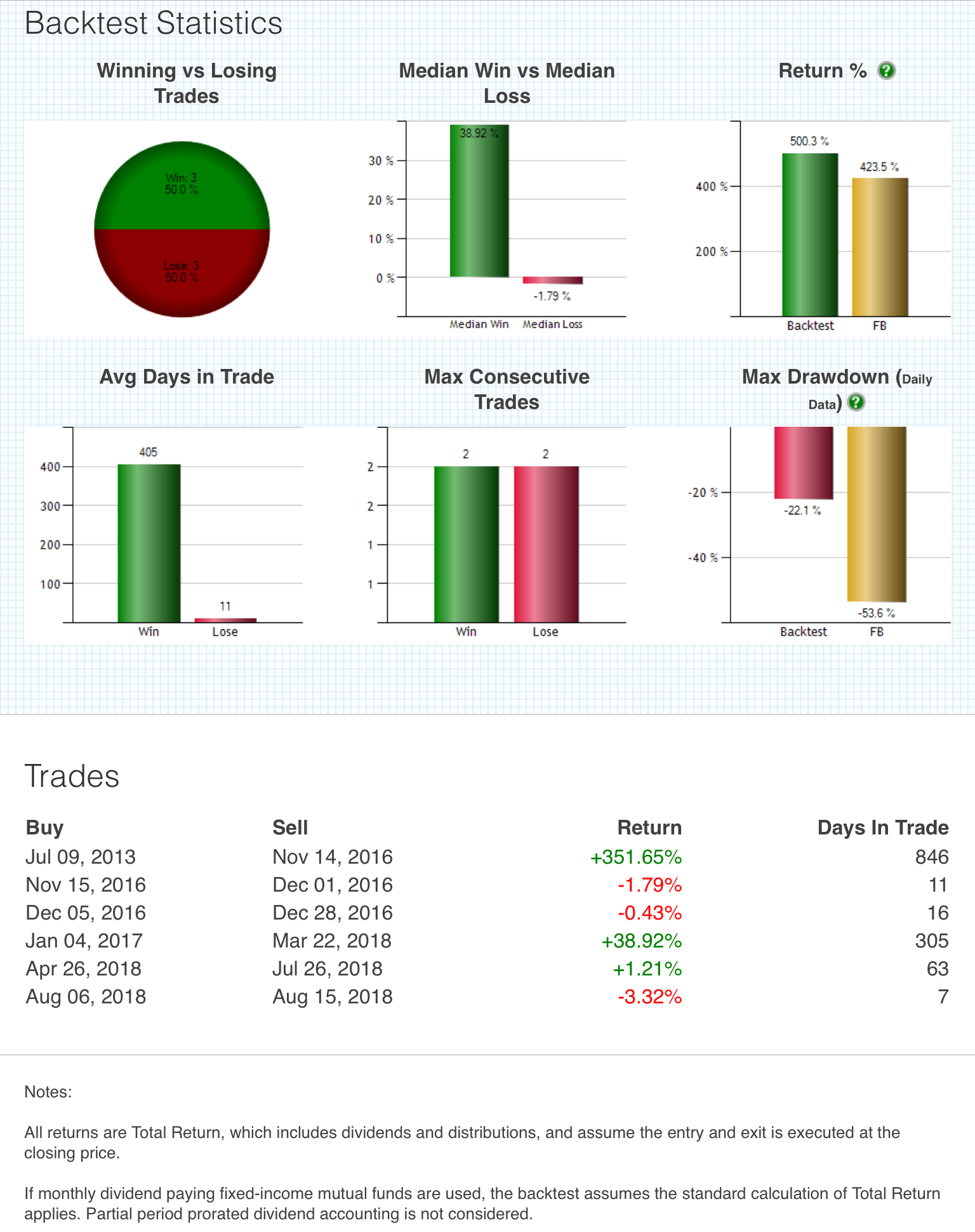

A moving average is a trend following indicator that can be used to filter price action and capture trends by keeping a trader long during up trends and in cash or short during downtrends. Here is an example of the key long term moving average on the Facebook chart that would have captured the uptrend and gotten an investor or trader out when the huge uptrend came to an end. Two key long term moving averages to watch on charts is the 200 day and the 250 day moving averages. They are not magic it is just math as an uptrend will eventually happen above a key long term moving average in a stock under accumulation. No matter how much you love a stock it is only good to hold it when it is in an uptrend. The biggest enemy of moving average trend trading is volatility, moving averages are not as useful in sideways are volatile charts. You can choose moving averages that work the best on your own trading and investing timeframe. Moving average crossover signals can help to filter out much of the volatility and get you out quicker than a long term moving average. In a portfolio of stocks a moving average can also signal you which stocks to cut your losses on and which winners to let run.

For 50 more moving average signals that beat buy and hold check out my newest book here on Amazon.

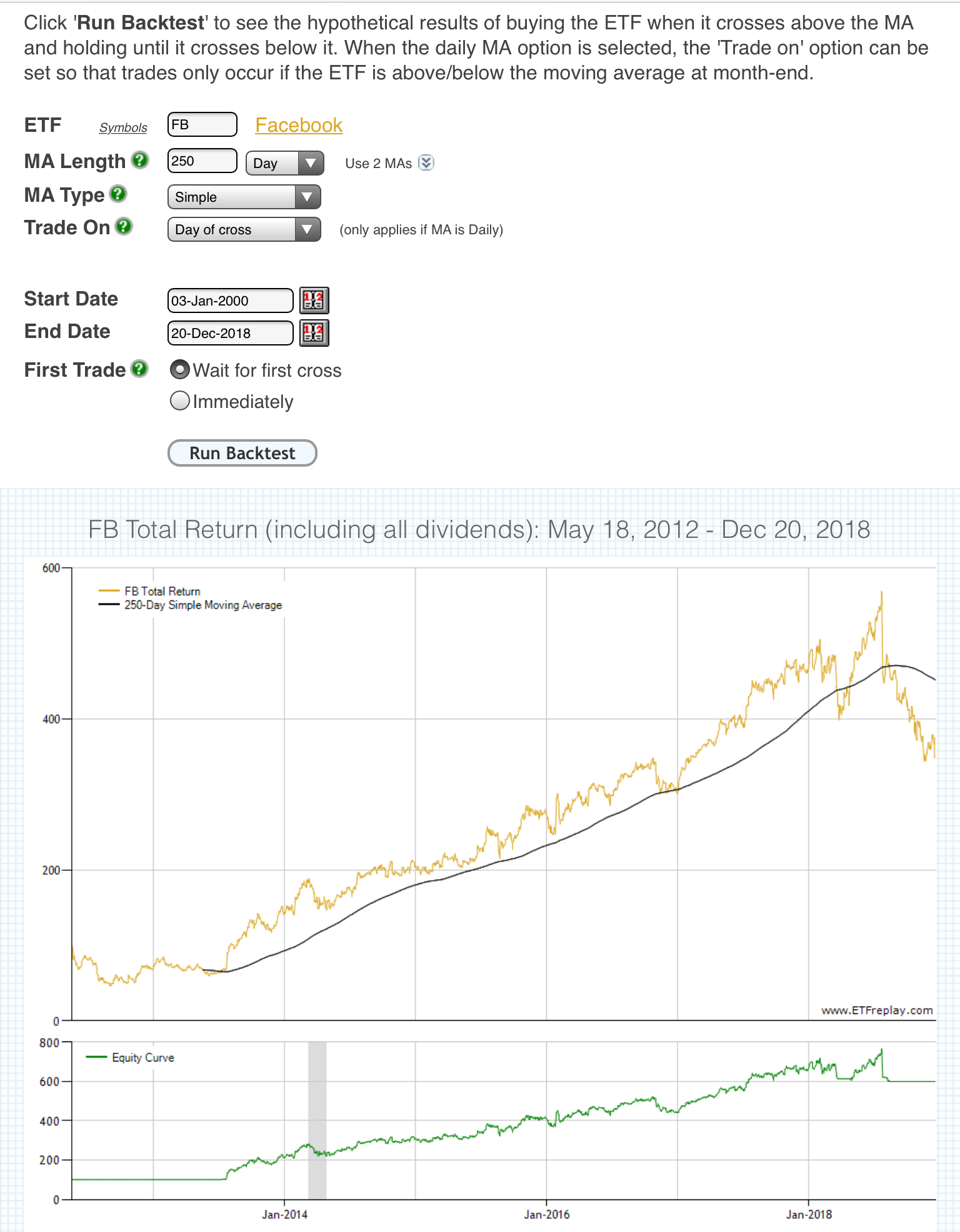

Below is an example of the 250 day simple moving average used as a trend filter on the Facebook chart since its IPO.

Data and chart courtesy of ETFReplay.com.