This is a Guest Post by AK of Fallible

AK has been an analyst at long/short equity investment firms, global macro funds, and corporate economics departments. He co-founded Macro Ops and is the host of Fallible.

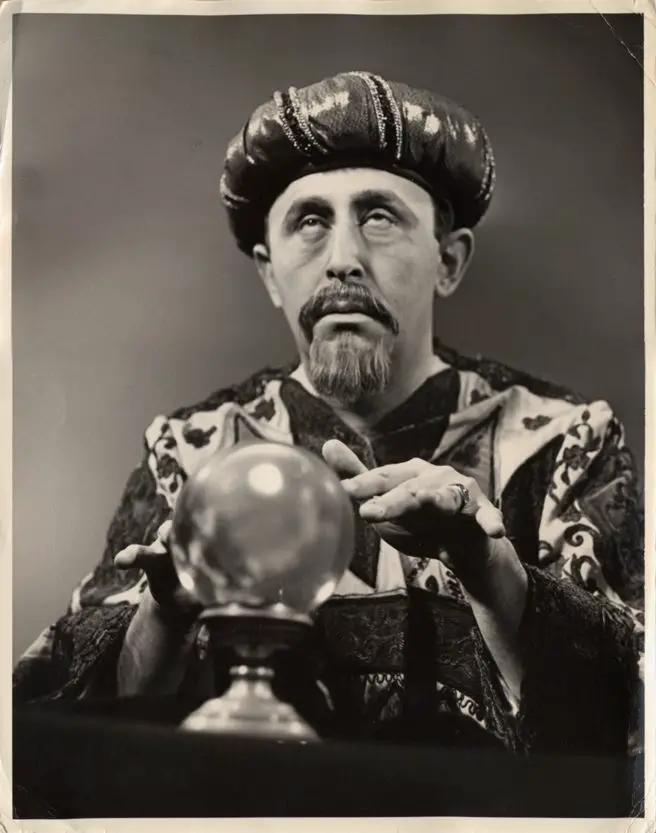

It is foolish try to “predict” the stock market. Real investing is all about weighing probabilities.

“Markets are context dependent, their behavior is a function of the particular circumstances that exist and how those circumstances are expected to or do change. The trick is not to predict an unknowable future, but to try to understand the present and the probabilities of the various paths that may evolve from it.” ~ Bill Miller

We often write that we’re not in the business of making predictions. Rather, our job is to gauge the asymmetry of outcomes.

We do this by determining what the consensus beliefs and positioning are by triangulating the macro, sentiment, and technicals. This helps us paint a picture of what expectations are already embedded in the price. Then we just weight these against possible future paths.

The larger the disparity between consensus and potential outcomes, the greater the asymmetry and the more attractive the bet (trade).

There are additional benefits to using this mental model versus the typical one of making predictions.

1. It helps protect you from yourself. Certainty is a killer in this game. When we play the prediction game, we put ourselves at risk of becoming champions to a cause and slipping into the pull of our ego driven tribal nature. This distorts our perception of the world and blinds us to new information.

2. Prediction making is linear and bimodal in nature. Markets are non-linear and endlessly dynamic. This fact causes prediction makers to live in friction and disharmony with markets — think the perma bears who’ve been on the wrong side of the market for years. They become stuck when their view of the world does not match up with how things actually are.

To learn more, make sure you watch the video above!

And as always, stay Fallible out there investors!