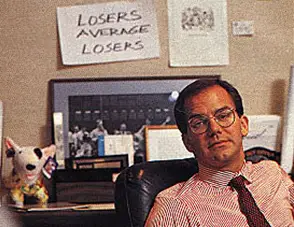

Jack Schwager reveals how Paul Tudor Jones (PTJ) learned risk management. As you’ll see, it was a tough process!

I love classic stories like this. They serve as reminders that the Market Wizard legends started out just like us! They screwed up the same way, had the same emotions, and everything.

Now there are a few lessons we can pull from PTJ’s story. And they all have to do with risk management.

First, you’ve got to realize that no one knows anything about markets! Not even the pros. Look at PTJ. He was so certain of the bottom. And his certainty backfired because he ATE it hard. The best traders assume they are always wrong and plan accordingly. They OBSESS with the downside.

That’s what investing is. As an investor, your actual job is being a risk manager. It’s always looking out for the downside. Investing is all about defense. It’s about trying hard to not lose money. If you do that, the upside will take care of itself.

In this story PTJ got too cocky and sized up on his bottom call. And because his position was too big, he ended up losing all his gains for that year. That’s something you need to avoid in markets — believing your own BS. Don’t drink your own Kool Aid and start thinking you’re really smart and make calls without any risk control.

In this case the emotions PTJ felt were actually helpful. Because of that pain, he always remembered from that day on how important risk management was.

To learn more, make sure you watch the video above!

And as always, stay Fallible out there investors!