This is a Guest Post by AK of Fallible

AK has been an analyst at long/short equity investment firms, global macro funds, and corporate economics departments. He co-founded Macro Ops and is the host of Fallible.

Is Elon Musk, the CEO of Tesla (TSLA), right about short sellers? Should what they do be illegal? That’s what we’ll discuss in this video.

Elon is a wild one. Recently he was tweeting, egging on the SEC. This is after he just settled with them…

Now this seems to be completely ego related and not a smart move at all. But what’s interesting is that within this series of tweets he also began calling out short sellers, saying what they do should be illegal.

But he’s in fact wrong. Short sellers provide multiple benefits for markets.

First, they provide liquidity. Short sellers borrow shares and then sell them. That means more sellers in the market in addition to buyers. And more buyers and sellers means more liquidity in the markets which is good for everyone because it leads to more efficient pricing and smaller spreads.

Short sellers also reduce volatility in the market. That’s because they do the opposite of most investors. Most investors are buying at highs and selling at lows. Short sellers sell at highs and buy back shares at lows. That ends up smoothing out the peaks and troughs in the market.

Short sellers are key in price discovery too. First, they help curb excessive speculation. They bring stocks that overvalued back down to fair value. In addition to that, they also serve as a police task force helping discover fraud and bring down bad companies.

In general short sellers bring balance to the market.

Follow AK on Twitter: https://twitter.com/akfallible

And Instagram: https://www.instagram.com/fallible_money/

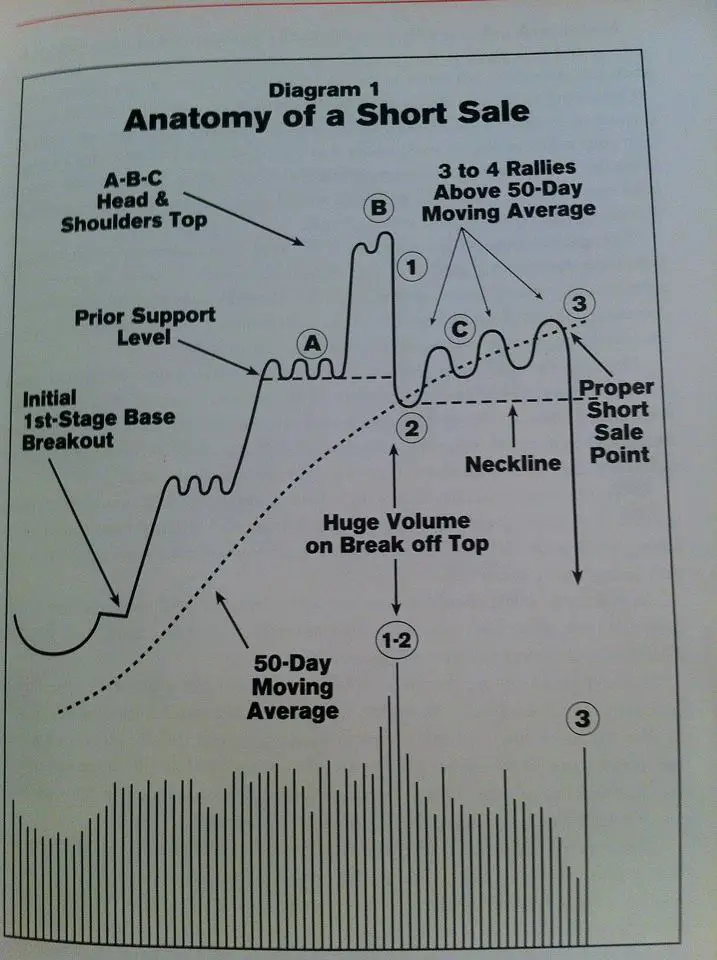

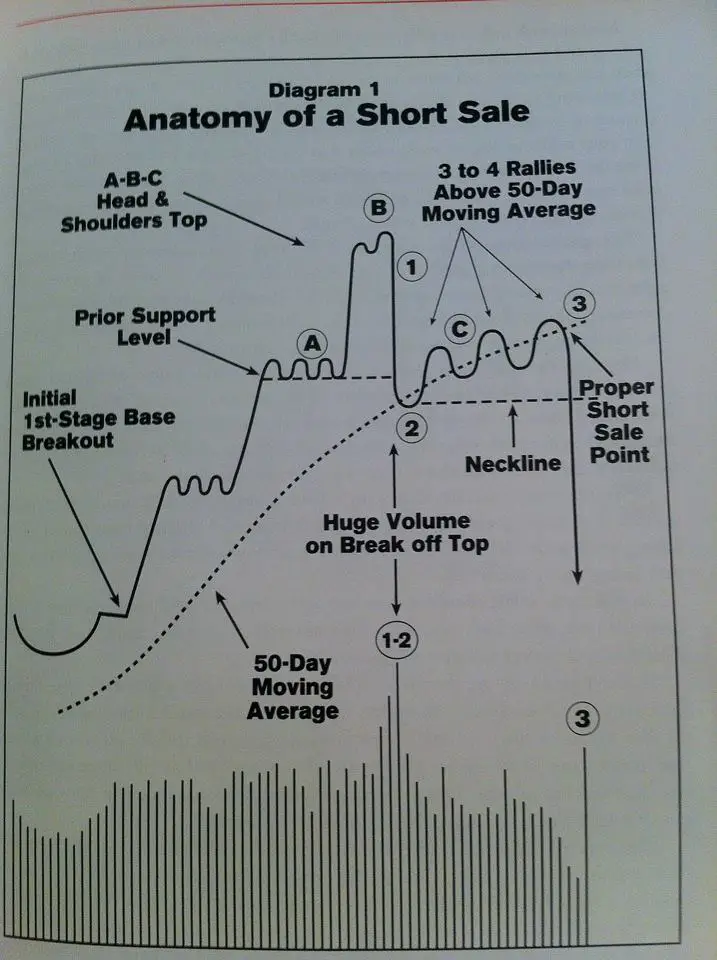

The below chart image is a page from “How to Make Money Selling Stocks Short” by William J. O’Neil.

***All content, opinions, and commentary by Fallible is intended for general information and educational purposes only, NOT INVESTMENT ADVICE.