As my trading career developed I began to think deeply about the market’s first principles. And that’s when I landed on a concept I now call the convergence/divergence property.

This property states that all trading strategies can be separated into two different buckets. There’s the convergence bucket. And then there’s the divergence bucket.

Convergent strategies look for prices to “revert back to a mean”.

When something falls below the mean, it’s considered undervalued, and you buy it. When something rises above the mean, it’s considered overvalued, and you sell it. The assumption is that price will move back towards the mean in either case. And you make money by being on the right side of that move. Standard stuff.

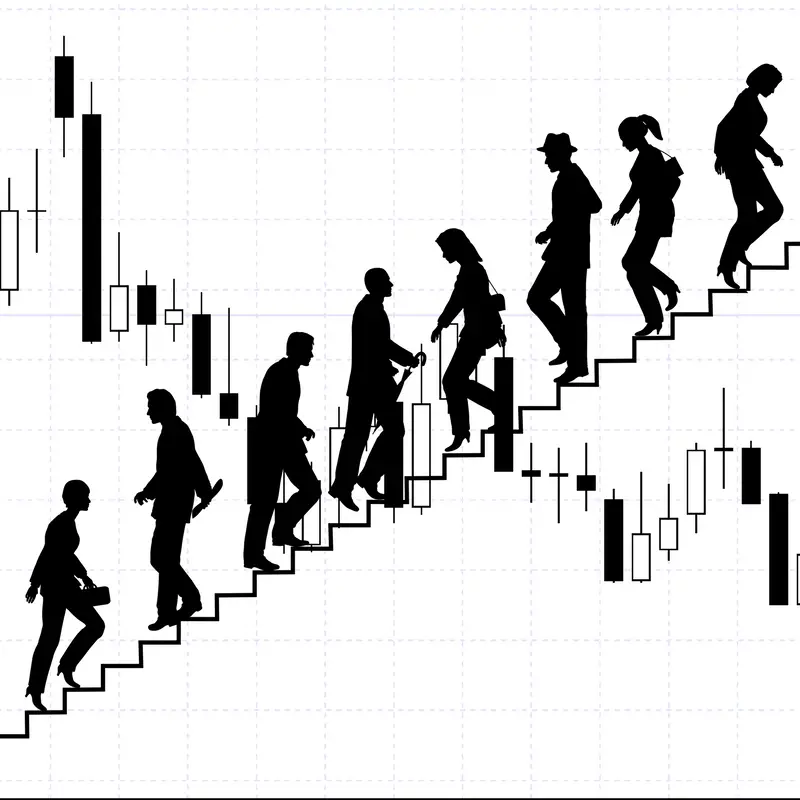

On the opposite spectrum of convergent strategies, you have the divergent strategies. Divergent strategies aren’t looking for a “reversion to a mean”. Instead, they look for an entirely new mean to be established. They profit from shocks to complex systems. When paradigms change, when things get disrupted, when new players enter and old players die, divergent strategies win. Droughts, wars, political unrest, and volatility all lead to success with a divergent trading strategy. These strategies love “breakaway” trends that redefine the mean.

Convergent strategies usually have high win rates, but at the expense of large losses. Divergent trading strategies are the exact opposite. They win less often, sometimes less than 50% of the time, but the winners are multiples of the losers.

Combining convergent and divergent trading strategies complement each other and help to smooth out account performance.

To learn more, make sure you watch the video above!

And as always, stay Fallible out there investors!