This is a Guest Post by AK of Fallible

AK has been an analyst at long/short equity investment firms, global macro funds, and corporate economics departments. He co-founded Macro Ops and is the host of Fallible.

Tony Robbins, the famous motivational speaker, also gives trading advice? Yup. He’s the performance coach billionaire investors go to in order to take their trading to the next level.

We talk about psychology a lot on this channel, and in the video above, Tony explains just how important it is through an example of one of his clients. This client is one of the greatest investors of all time, and to give you a hint of who it is, in the 1987 crash he made half a billion dollars in a single day.

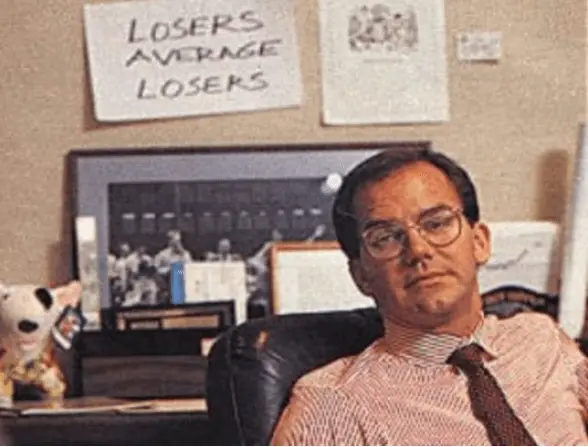

It’s Paul Tudor Jones!

Yup, in the video above Tony talks about exactly what he does for PTJ, and as you’ll learn… it’s mostly psychological work. It’s just like Wendy in Billions. The role she plays is REAL. The actress playing Wendy actually studied Tony Robbins in depth and even worked with him directly to create the role.

And just like we saw Axe pay Wendy a ton of money in Billions, PTJ pays Tony Robbins a million a year plus upside in the fund. If these guys are paying that much for it… then you know it’s important.

But you don’t need to pay millions of dollars for a coach like Tony or Wendy. There’s a simple method you can use to become your own coach. And that method is a trading journal.

Keeping a trading journal is a key part of separating your rational self from your emotional self. First you start with creating a trade plan, something your rational self does. Then you go on to execute that plan while recording that execution in your trading journal. And whether you like it or not, this is done by your emotional self. And finally you review your trade journal afterwards, which is once again done by your rational self. You see how they’re separated?

If you’re interested in learning more, make sure to watch the video above.

And as always, stay Fallible out there investors!