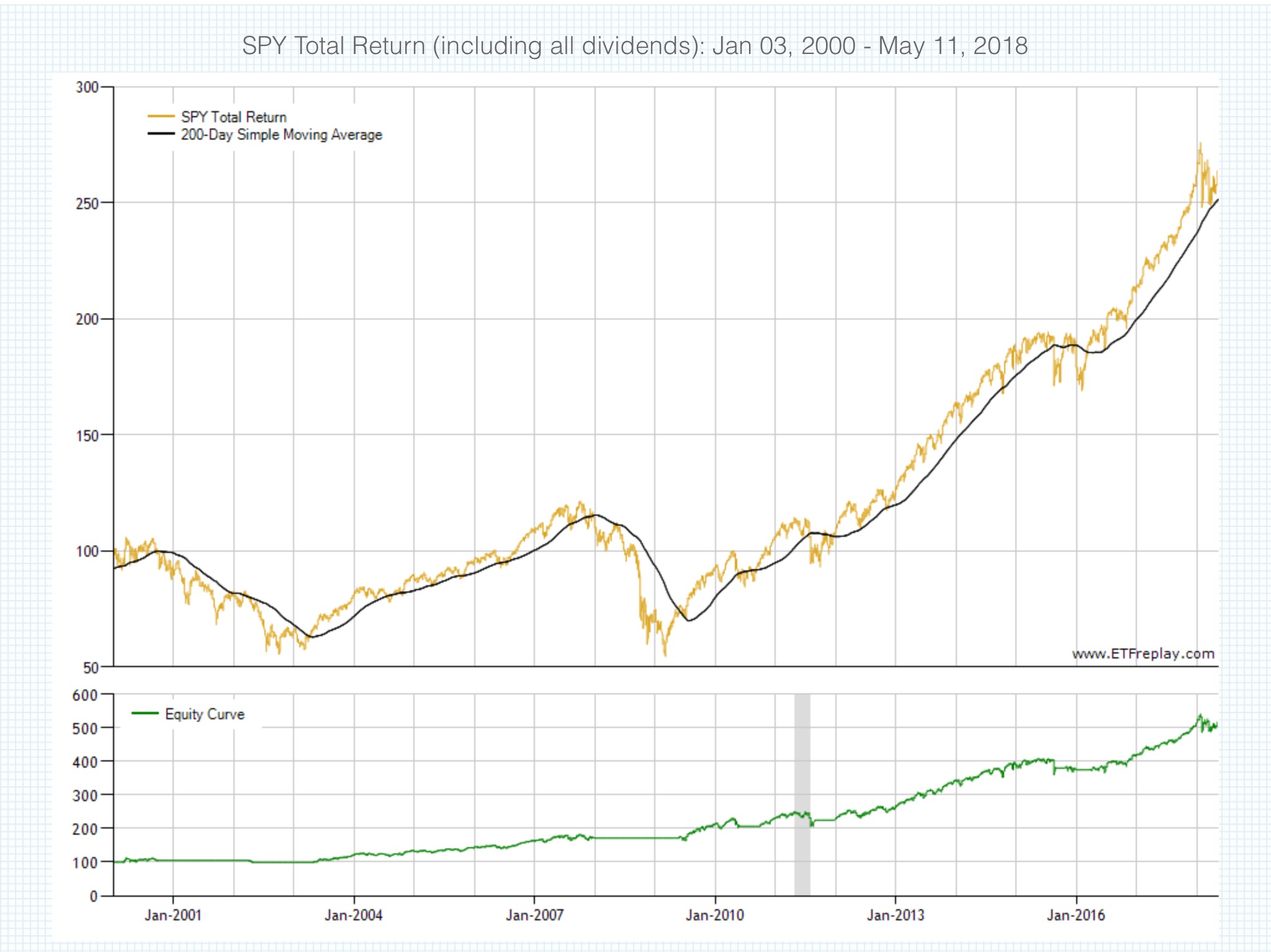

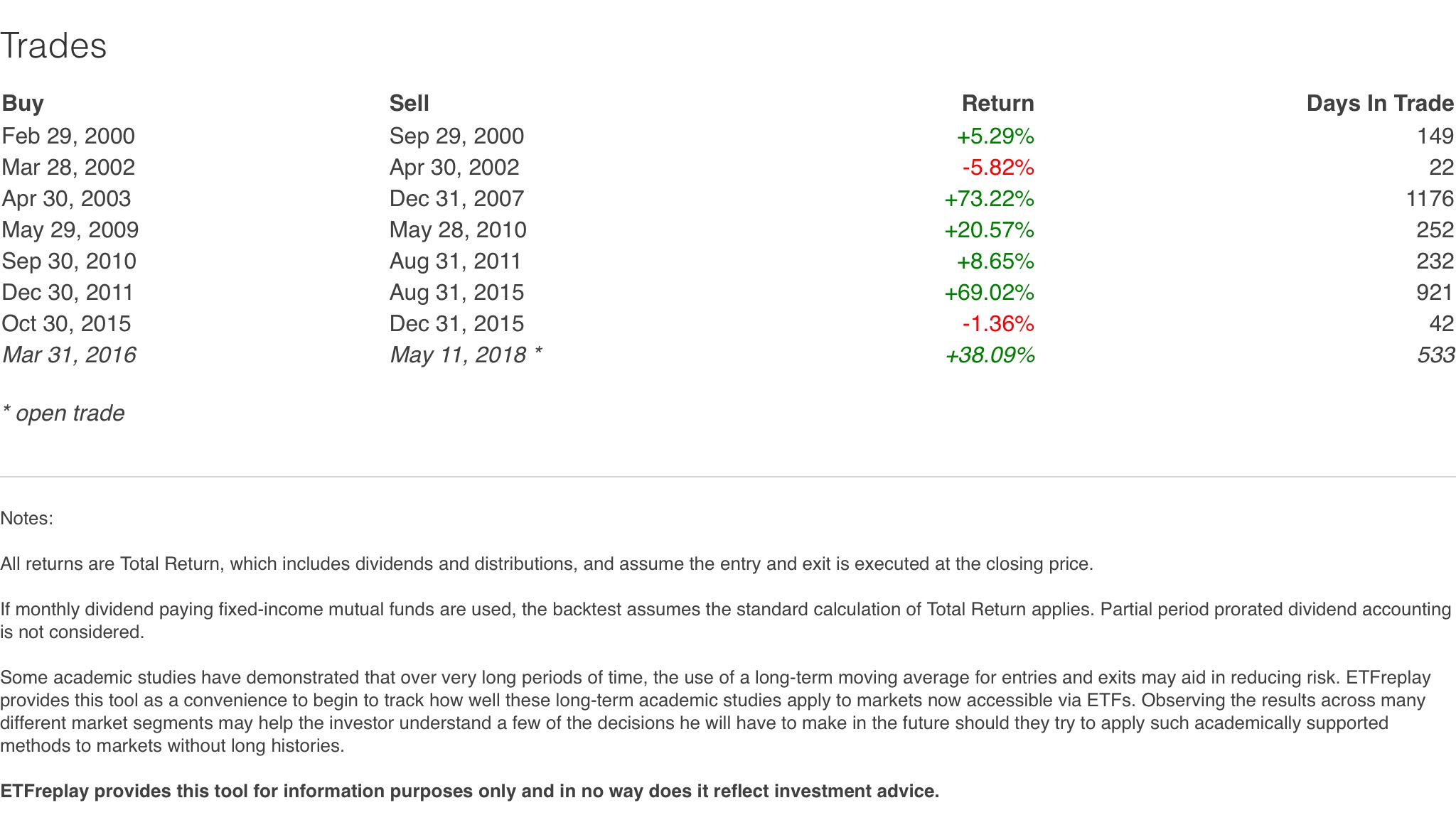

What if I told you there was an incredibly simple moving average system that crushed buy and hold investing? It is not that complicated and only takes one action on the last day of the month to execute it. It over doubles the returns in the S&P 500 index and cuts the drawdown in half. What is it that can do what so few mutual funds and hedge funds can? Beat the S&P 500? The popular 200 day simple moving average is one of the most popular market signals and backtesting shows since the year 2000 it has worked best as an end of month signal. Below is the results if you simply bought $SPY and held if price ended the month over the 200 day but sold and stayed in cash if the $SPY price was under the 200 day SMA on the last day of the month. Market timing of the below 8 trades does not get much better than this avoiding the two major bear markets of the past 17 years but capturing the bull market profits.

Here are four more $SPY moving average systems that beat buy and hold here.

Here are seven $QQQ moving average systems that beat buy and hold here.

Backtest data is courtesy of ETFreplay.com