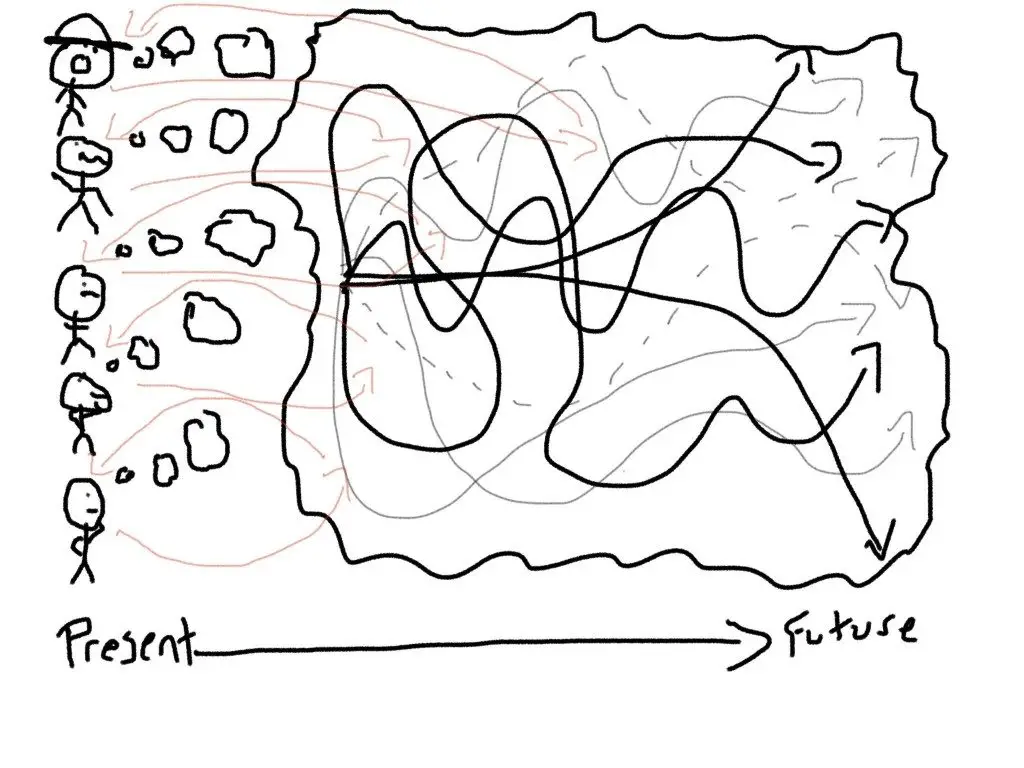

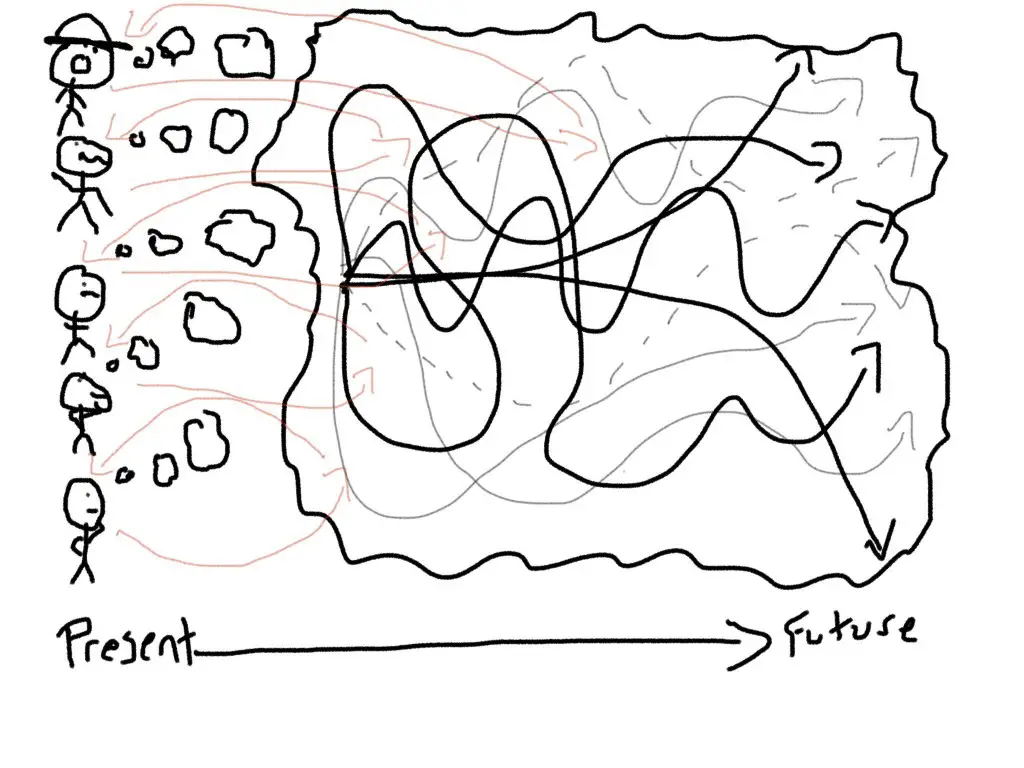

The normal path of nature has fragile things like living creatures and mechanical things follow a ‘bathtub curve’ where, after being a baby then child the probabilities of death increases as time goes by. For fragile things age and health determine the probability of continued survival which is the basis of insurance companies mortality tables

In contrast, the Lindy effect is a concept that expects and projects that the future life expectancy of some anti-fragile things like a trend, company, stock, tech, or idea is the magnitude of their current age, so that every added time period of continual existence and survival implies a continuing life expectancy. When the Lindy effect applies to something, the mortality rate actually decreases with time. Survival implies continuing to survive. A trend implies the trend continuing. The odds are on winners continuing to win and losers continuing to lose. The odds are more a dominant sports team continuing to have a winning season than a losing franchise suddenly winning.

“If a book has been in print for forty years, I can expect it to be in print for another forty years. But, and that is the main difference, if it survives another decade, then it will be expected to be in print another fifty years. This, simply, as a rule, tells you why things that have been around for a long time are not “aging” like persons, but “aging” in reverse. Every year that passes without extinction doubles the additional life expectancy. This is an indicator of some robustness. The robustness of an item is proportional to its life!” – Nicholas Nassim Taleb (Anti-Fragile)

The companies that dominate their industry will likely survive for as long as they have previously existed. Existing and growing generally leads to continual growth and existence. A profitable back tested trading system has the potential to continue to work as long as the previous back test period showed profitability. This is a fascinating way to look at the probability and possibility of future trends, robustness and durability by looking at the previous magnitude of success.