This is a guest post by Clint Siegner is a Director at Money Metals Exchange.

One of the biggest questions for new buyers for precious metals is “What should I buy?”

The first rule often addressed is to avoid collectible or numismatic coins and the exceptionally high premiums that dealers charge for them. This discussion will lead into, how to determine which of the precious metals to own and provide some guidance regarding which bullion coins, rounds, or bars will meet your objectives.

Should You Buy Gold, Silver, Platinum, or Palladium?

Silver looks undervalued relative to gold at the moment. The gold / silver ratio is currently around 60, which is to say one ounce of gold is priced at about 60 times the price of an ounce of silver. This ratio has generally been much lower on a long-term historical basis. Combine that with some pretty compelling supply / demand fundamentals, and it appears silver will continue to outperform over the medium to long term.

That said, during period of extreme fear and uncertainty, gold will outperform silver and be less volatile. Gold benefits from its ultimate status as a safe haven. A gold portfolio has been the steadiest and most profitable asset class over the past decade.

Platinum and palladium also present an opportunity for investors who want to be more aggressive and who wish to diversify. Platinum, with its price per ounce still below that of gold, looks particularly compelling. However, both platinum and palladium often trade more like industrial metals than monetary platinum and palladium so, in some respect, your investment is a bet on stabilization or improvement in worldwide manufacturing.

General guidelines:

- Buy gold if your priorities are wealth preservation and safety with lower volatility and risk – or if your investment time horizon is under 3 years.

- Buy silver if you want a combination of wealth preservation and greater potential appreciation.

- Buy some platinum or palladium if you want to diversify your precious metals holdings into alternative metals with their own unique fundamentals.

Determine the Purpose of Your Bullion Investment

Customers typically build a precious metals portfolio for some combination of the following reasons:

- Long-Term Appreciation

- Diversifying Their Cash

- Holding inside an IRA

- Barter and Trade Potential

- Speculation (Including Trading the Gold / Silver Ratio, Etc.)

Investors focused on holding for the long term should give priority to finding the lowest premium. In a bull market for precious metals, it is the ounces you own that will produce the investment returns. The lower the premium the more ounces you will acquire. (As a general rule, premiums can be expected to fall as a percentage of the value of a coin, round, or bar as precious metals prices rise).

Always remember to consider the marketability of what you buy – you will most likely want to sell at some point! Most investors should avoid 1,000-ounce silver bars. These large bars carry low premiums, but they could be discounted when it is time to re-sell – unless the bars have been kept in an approved storage facility (thereby avoiding a re-assaying fee). There will also be a smaller pool of prospective buyers for bars of that size – especially if you are in a hurry or try to sell back to a small coin shop rather than a large national dealer like Money Metals Exchange.

Investors with a self-directed precious metals IRA should focus on low premiums, as they are also oriented toward long-term appreciation. However, certain low-premium options, such as pre-1965 90% silver coins or gold Krugerrands, are not allowed in an IRA because of federal rules relating to purity. Neither are “rare” coins, but those tend to be a poor investment anyway, except for individuals who are true rare coin experts.

Even as some in the financial establishment begin to warm up to precious metals, they continue to scoff at the possibility of a total fiat currency collapse and the necessity of using precious metals for barter and trade. However, those who pay attention to history and to current events know better than to rule out that possibility.

History, including examples from the past decade, is replete with currency crises precipitated by governments that borrow, spend, and devalue their currencies to the point they utterly fail as media of exchange. The prudent are adding some component of smaller-denomination bullion in trusted and recognizable forms to their overall metals portfolio. Fractional-sized gold (American Eagles and rounds) and silver (“junk” silver and rounds) will give you more flexibility in barter situations.

Don’t Lose Your Position in Precious Metals by Trading In and Out

In regards to short-term trading, people should try to avoid trading in and out of their core holding of physical metal. World events can move markets suddenly and without warning, so you absolutely cannot risk giving up your core position in this environment. However, there are opportunities to increase the ounces in your overall holding by swapping one metal for another – trading the gold / silver ratio.

Currently at levels above 70, this ratio favors over-weighting silver. Should silver prices move violently upward in relation to gold, it may then make sense to swap silver for gold. Savvy metals investors have used this technique to reap even greater returns – without ever abandoning safety or gambling their position in this bull market for precious metals.

Keep Transaction Costs Low

When it comes to choosing a bullion form best suited for trading, investors should focus especially on keeping the transaction costs as low as possible. In physical bullion, there are two components in the transaction cost; the buy-sell spread (also known as the bid-ask spread or the difference between the premium you pay to buy your metal and the premium or discount you receive to sell your metal back) and the shipping expense.

And finally, in many jurisdictions there is a third component in your transaction costs that must be considered – sales tax.

What Do You Like?

As a general rule, the buy-sell spread is low and does not vary a great deal from one bullion form to another. However, you will pay a little more to buy American Eagle coins versus other forms of gold or silver bullion. You can expect to get a little more for them when it is time to sell back, but the premiums on them are unlikely to rise as much as the metal itself.

Some appreciate that American Eagles are beautiful and well recognized, and they are happy to pay a bit higher premium to buy them. Others prefer things like pre-1965 silver coins because they generally offer the lowest premium, are widely recognized and salable, and are legal tender for their face value (just like Eagles). Buyers of pre-1965 coins don’t mind that the coins are worn and that the metal content isn’t displayed.

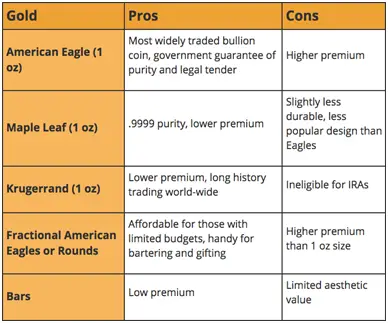

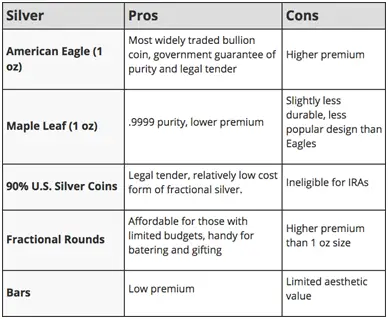

Above are charts outlining some of the pros and cons of the most popular bullion forms to help you zero in on which forms will best suit your needs, preferences, and budget.

About the Author:

Clint Siegner is a Director at Money Metals Exchange, the national precious metals company named 2015 “Dealer of the Year” in the United States by an independent global ratings group. A graduate of Linfield College in Oregon, Siegner puts his experience in business management along with his passion for personal liberty, limited government, and honest money into the development of Money Metals’ brand and reach. This includes writing extensively on the bullion markets and their intersection with policy and world affairs.

Clint Siegner is a Director at Money Metals Exchange, the national precious metals company named 2015 “Dealer of the Year” in the United States by an independent global ratings group. A graduate of Linfield College in Oregon, Siegner puts his experience in business management along with his passion for personal liberty, limited government, and honest money into the development of Money Metals’ brand and reach. This includes writing extensively on the bullion markets and their intersection with policy and world affairs.