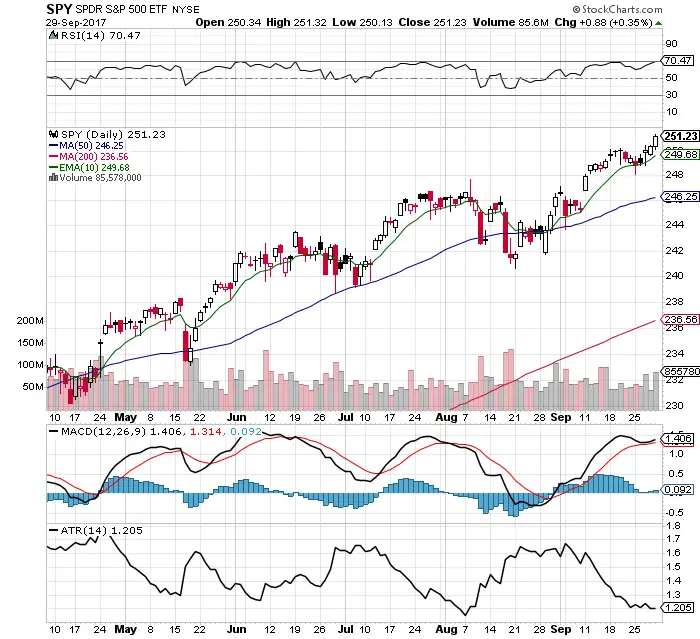

- All bull signals are a go here as the uptrend in price continues over every moving average.

- The 10 day ema has provided end of day support for 22 straight trading days.

- The trading range and volatility continues to fall creating the most calm September trading in history. VIX falls to a historically low 9.51.

- $SPY is at rare overbought air at the RSI 70.47. This does not mean we will necessary go down but that the uptrend likely slow and go sideways as the overbought conditions are worked through with a price base.

- The stock market reacted well to President Trump’s tax plan, with small caps, micro caps, and financials leading the way.

- $SPY continues to have a bullish MACD crossover it was under a bullish cross for all of September.

- This market rewards buy and hold investing and quick dip buyers. Crash callers that remain short continue to miss the gains and lose money fighting the trend higher.

- Many leading stocks pulled back and rallied off lows, $AAPL $FB $AMZN $NFLX and $GOOGL.

- Volume increased on the biggest up days last week.

- The $XLE rally continues helping $SPY go higher with its energy holdings.

I am still long $UWM and $ERX from weeks ago and added $QLD in Friday.