Skip to content

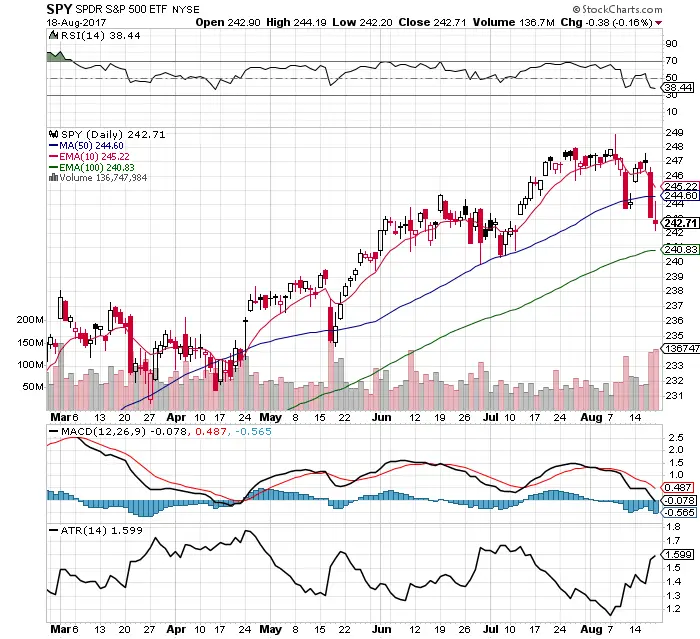

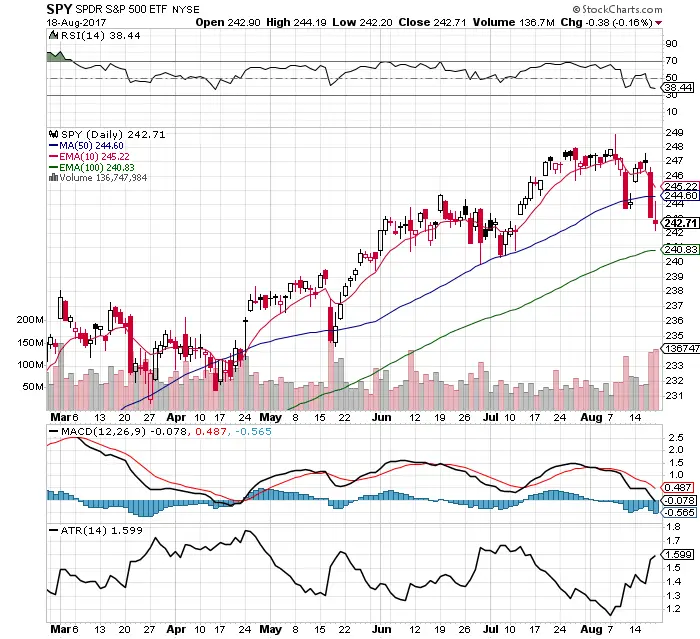

- The market dynamics changed last week as $SPY lost the 10 day ema and 50 day sma shifting $SPY into a sideways market.

- The next key support level convergence comes near $240 as the RSI will be in the lows, the 100 day sma, and the 100 day sma.

- The small caps ETF $IWM has begun a downtrend under the 200 day while big caps have held up much better.

- MACD is still under a bearish cross.

- RSI is at 38.44 with room to become more oversold to the 30 RSI.

- The average trading range continues to increase.

- $VIX continues to increase at 14.26. $VIX 15-17 has been a good zone to buy dips in.

- Energy sector continues to trend down .

- Leading stocks are still holding up in ranges. $FB $AMZN $AAPL $NFLX $GOOGL

- I am looking to buy more of a dip here. My only position is currently $TNA.