This is a Guest Post by David Bergstrom, he is on twitter @dburgh he is the guy behind the Build Alpha software. He has spent many years researching, building, testing, and implementing market making and trading strategies for a high frequency trading firm, a handful of CTAs, individual clients, registered money managers, and even aspiring retail traders. His website is BuildAlpha.com.

This is not a typical blog post from me; I generally write about system trading ideas, testing methods or analyzing some free strategy I’m giving away.

However, I was recently speaking to my friend about asset management and the topic of “how young is too young” came up. I was slightly curious, and as most of you know by now, I do not make decisions without looking at some data. Plus we joked that with all the 17 year old hedge fund managers out there the median age of when Hedge Fund founders begin their fund might be lower than we think.

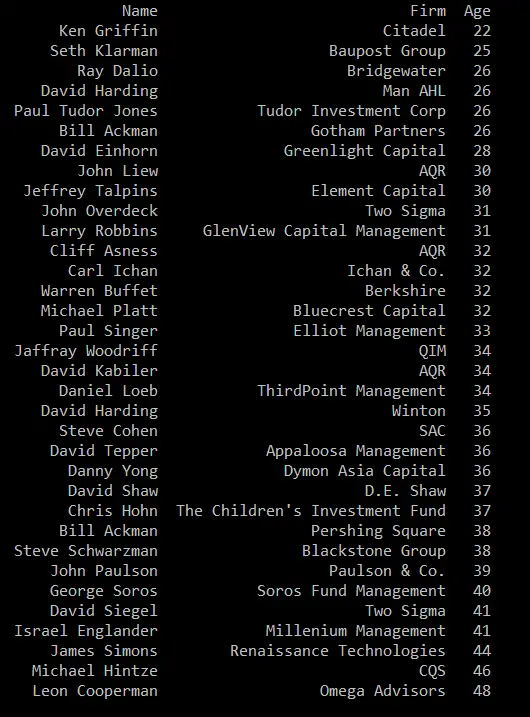

So I put together a quick list just to get an idea of the median age of the founder at the time of starting his/her firm of some of the most prominent players in this sport. As someone who analyzes data for a living, I understand my sample is subject to selection bias and survivorship bias but this was still fun to look at.

The list is subject to selection bias because I only chose names that I have probably only heard of because of their success or because I saw them on a Forbes list. Furthermore, the list is subject to survivorship bias because the list only includes funds still in existence and not the many that have since closed.

Regardless, the list serves as a decent barometer of what success looks like in a general sense and I think it makes for an intriguing blog post nonetheless. Plus let’s face it… it is more fun to analyze the winners (especially when not putting any money behind the analysis).

Side note: if you’re curious about last year’s top earners here is a Forbes list I stumbled upon Forbes List 2016

I should also point out I compiled this data in haste and did not take birth month/date into consideration. If the fund was formed before the founder’s birthday in the founding year then I did not give the founder the benefit of the doubt. I simply subtracted the founder’s birth year from the founding year to establish a general idea of age. Corrections and clarifications are welcome as I think this is a cool list for us to keep track of for whatever purpose(s) down the road.

If I messed any of this up I apologize to all of the legends out there. If I left any one off this list that should be included please inform me and it was by no means intentional; just a late night, two scotch deep, google search.

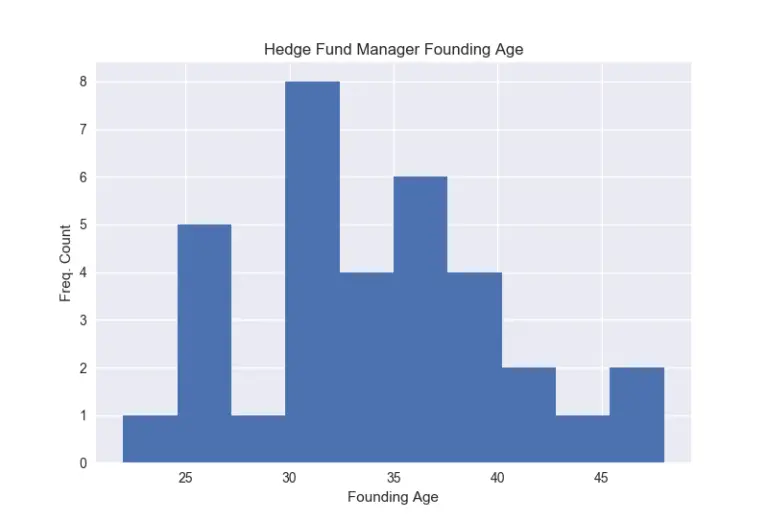

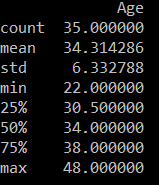

All in all, here is the distribution of ages to visualize. Note the median age to start was about 34 years old

Is this information useful? Probably not, but it is cool to look at and certainly intriguing to see some of the success stories on here. Maybe you’re the next Ken Griffin or maybe the next Leon Cooperman. Maybe you don’t care to start a fund and just want to automate your trading so monitor the markets from a beach – what do I know?

Either way… if you’re looking to start your own firm, need some systematic strategies or just want to test your existing ideas then don’t forget to check out Build Alpha.

Thanks,

Dave

For more articles by David Bergstrom check him out he is on twitter @dburgh and here on BuildApha.com.