Skip to content

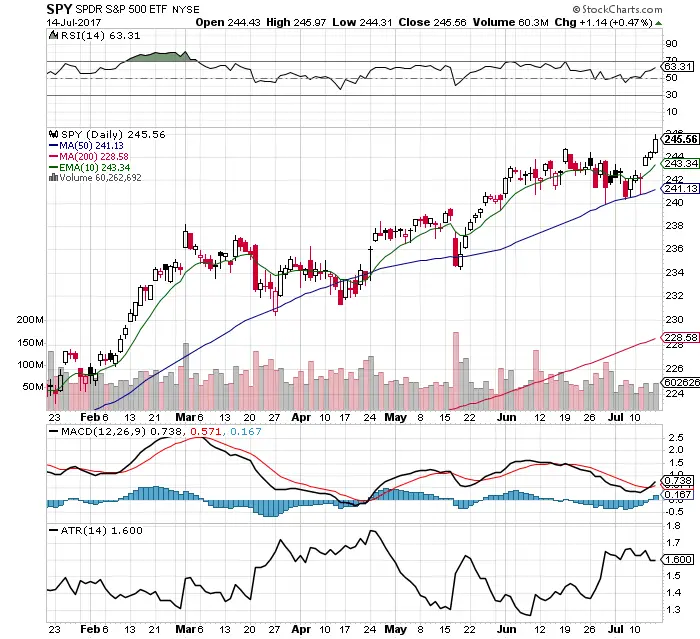

Chart Courtesy of StockCharts.com

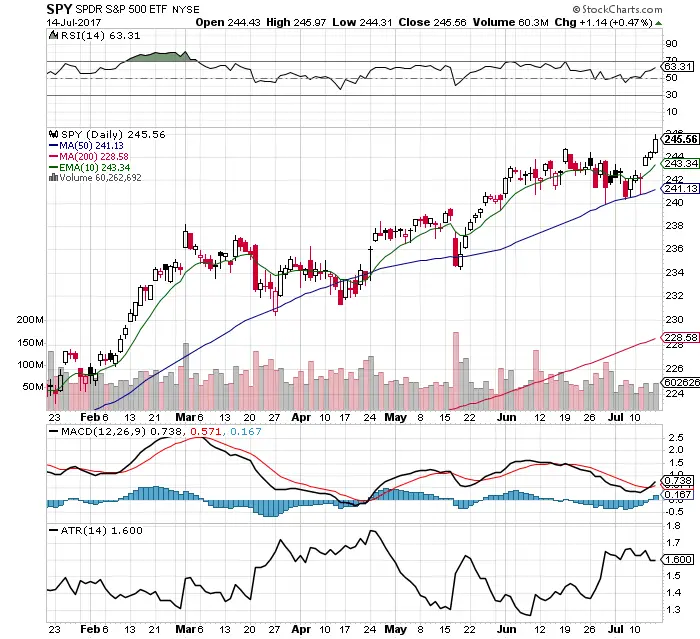

Chart Courtesy of StockCharts.com

- The most bullish signal is all time highs. A these levels only profit taking provides resistance as stop losses and trailing stops are not triggered.

- $SPY remains in an up trend as price remains above all moving averages.

- The 50 day SMA held as support last week.

- SPY is under a bullish MACD cross over.

- The price range has increased over the past few weeks giving day traders and swing traders opportunities to trade on shorter time frames.

- Last weeks new high prices were made on low volume.

- VIX at 9.51 is near 10 year lows in volatility. This is very bullish and creates very cheap put options.

- There is still room for higher prices with RSI at 63.31.

- Leading sector ETFs are $XLB $XLK $XLF $XLI $IBB $SMH and $XLV. Lagging sector ETFs are $XLP $XLE $XRT and $XLU.

- This market has favored buy and hold investors in indexes and FANG stocks since the presidential election.