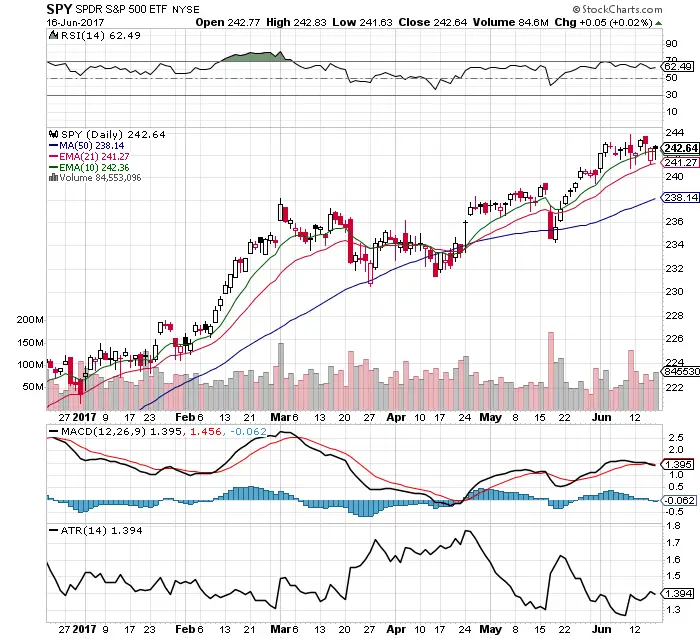

- SPY remains bullish as it is near all time highs.

- SPY has been in a trading range for two weeks $244 resistance and $241 support.

- The average true range for price expanded last week to give day traders more room to work.

- $VIX remains low at 10.38 with resistance at a 12 VIX.

- The trading range has expanded as the 21 day EMA has become the new moving average for support.

- RSI remains high at 62.49 but there is room to move higher. The probability is on building more of a price base here and staying in a trading range.

- The MACD just had a bearish crossover.

- Mega caps, financials, and energy all held up strong last week and were for the first to go green on most down days. $DIA $XLF $XLE.

- Tech was week last week making lower lows. XLK QQQ

- No clues in volume last week as up and down days were very similar.

I am currently long small caps in a trend trade and holding $UWM. I am watching QQQ for a buy signal on a deeper dip near the 30 RSI or a 5 day / 20 day EMA bullish crossover.