This is a guest post from Kim Iskyan, publisher of Stansberry Churchouse Research, an independent investment research company based in Singapore and Hong Kong that delivers investment insight on Asia and around the world. This post originally posted at “Why you need to act when an investment isn’t working out” and is republished here with permission.

In economics, “opportunity cost” is the value you give up by making a choice. The real cost of a choice is not just the time and money you spend on it; it is the value of the alternative. Investors face opportunity cost in every investment decision.

Let’s say that on November 1, 2014, you bought $10,000 worth of Baidu (ticker BIDU on NASDAQ), the Chinese web services company. Earnings were surging, the company’s growth outlook was exceptional, and analysts were pounding the table to buy.

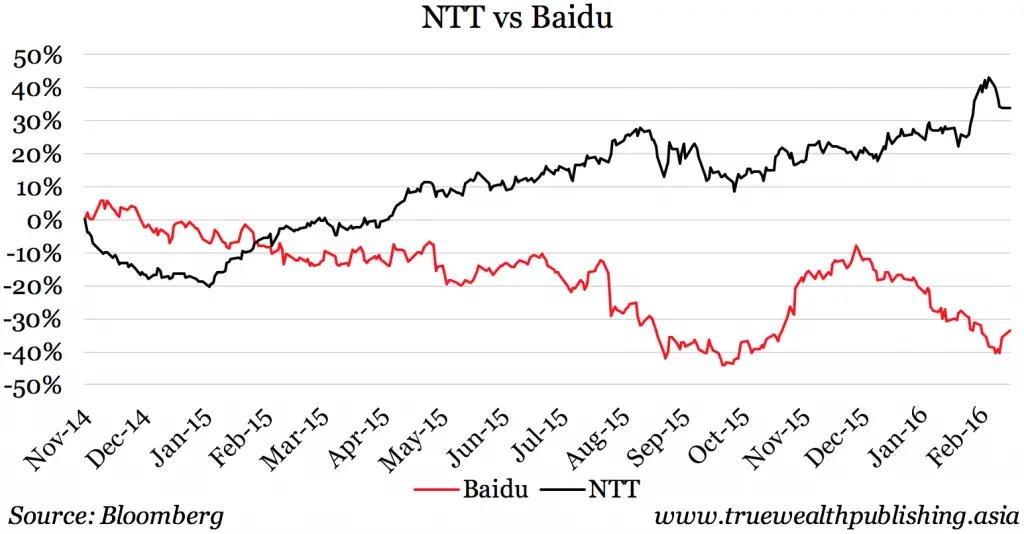

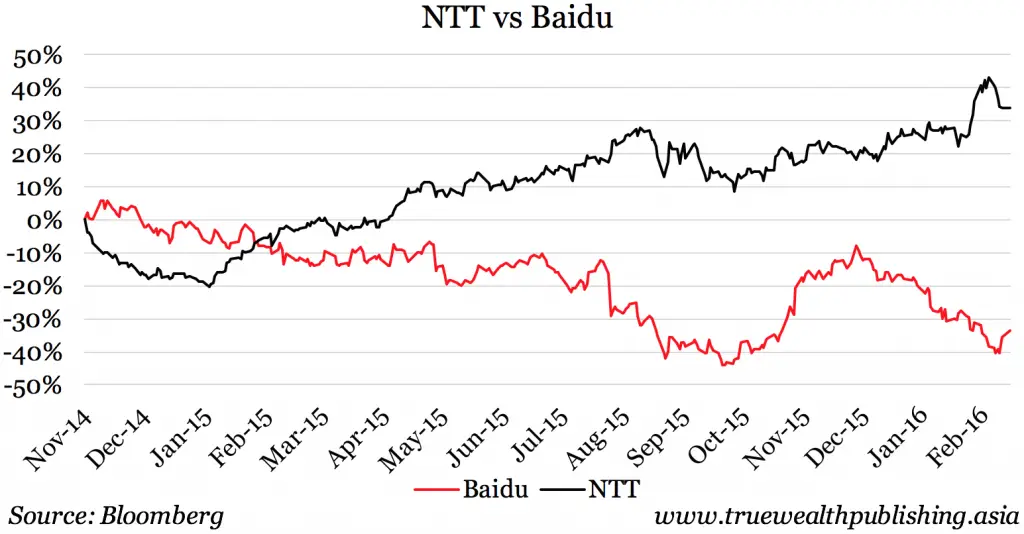

You did some research and bought at $242 per share. But things didn’t go well and sixteen months later, Baidu traded at $145 per share, a loss of 35 percent.

Another stock caught your eye that fateful day. It was Nippon Telegraph (NTT on the New York Stock Exchange), the Japanese telecom company. You could have bought it at $31 a share. The stock, and market, seemed boring, and a major analyst had just downgraded NTT. So you passed.

Sixteen months later, NTT was at $45 per share, for a gain of 42 percent (not including dividend payments of nearly 3 percent).

Your $10,000 Baidu investment is now worth $6,500. Had you invested in NTT, the same $10,000 would be worth nearly $15,200. Your unfortunate decision to buy Baidu shares resulted in a $3,500 loss. Add that to the $5,200 you did not receive by investing in NTT, and you have an opportunity cost of $8,700.

Of course, you had no way of predicting the two stocks would perform so differently. However, as the chart below shows, an investor would have had many opportunities to sell Baidu shares and buy NTT shares. If the investor admitted that he had chosen the wrong stock and swapped the “dead money” in Baidu to buy NTT stock, he would have had a lower opportunity cost.

Cutting losses is one of the most difficult decisions an investor has to make. As we’ve said previously, the sunk cost trap is a pitfall where an investor judges an investment based on the time and money already “sunk” into it. It’s hard to admit failure, so you keep soldiering on, hoping things will get better, despite evidence to the contrary.

Seasoned investors always look at each portfolio holding and ask: “If I didn’t already own it, would I buy it today?” If the answer is “yes,” then holding a stock that’s lost value may be warranted. If the answer is “no,” it makes sense to sell and move on.

It’s important to establish rules before buying shares to avoid the pitfalls of emotional investing. In particular, a trailing stop is an easy, effective way to limit your losses.

At the same time you buy a stock, enter a trailing stop order that will fill when the share price falls by say, 25 percent. No hand-wringing or anguishing over what to do – you’re out automatically.

As an investor, it may be painful to take a loss, but doing so may allow you to find a better opportunity and reduce your opportunity costs.

This is a guest post from Kim Iskyan, publisher of Stansberry Churchouse Research, an independent investment research company based in Singapore and Hong Kong that delivers investment insight on Asia and around the world. You can also follow them on Twitter @stchresearch .