This is a guest post from Kim Iskyan, publisher of Stansberry Churchouse Research, an independent investment research company based in Singapore and Hong Kong that delivers investment insight on Asia and around the world. This post originally posted at This sector rotation strategy will help you pick 2017’s winners and is republished here with permission.

Markets and economies move in cycles. So do sectors within a market – in a way that’s more predictable than you might think. And an easy investment strategy that’s produced outstanding results over the past 10 years suggests the sectors that will perform the best in 2017.

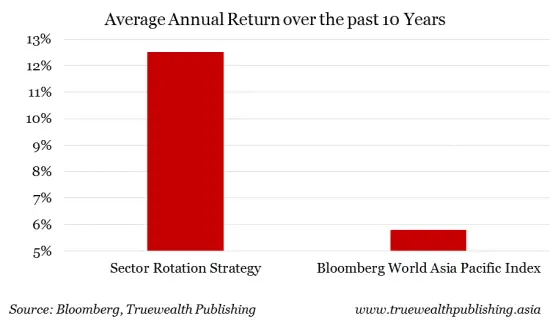

Last year, we found that an Asia investment strategy of buying the worst-performing sector of the year at the beginning of the following year – and then holding it for 12 months – resulted in an annual average return that was more than double the return of the index. The strategy suggested that Asia’s energy sector –the worst-performing sector in 2015, falling 21 percent – would lead the way in 2016. It wound up rising 5 percent (compared to the 2 percent decline of the Bloomberg World Asia Pacific Index) and was the second-best performing sector for the year.

What does this strategy say for 2017?

Avoid a common investment pitfall through rotating sectors

As an investor, it’s easy to follow the herd and buy the stock that’s been rising for a long time – because it feels like it’s going to continue to rise. This is called the status quo bias, which is when we tend to think that things are likely to remain the same – because our most recent memory is of them being a certain way. Investors buy a stock that’s been steadily rising in price because they expect it to continue going up. Investors expect a bull market to continue because, well, the market has recently been rising.

But markets are like seasons; they move in cycles. They all rise and then they fall, and then they do it all again. Just as you wouldn’t buy shorts as autumn approaches (even though everyone else has been buying shorts all summer), you shouldn’t buy into a sector just because it’s been going up for a long time.

This is how to rotate your sectors

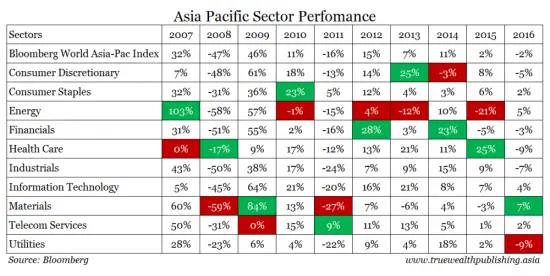

Sectors of the stock market do better, or worse, each year as their component stocks perform well, or perform poorly. The chart below shows the performance for each sector of the Bloomberg World Asia Pacific Index by year.

Each year’s best-performing sector is highlighted in green, while the worst-performing sector is highlighted in red (the overall index’s performance is the first row). So, for example, in 2014, the index rose 11 percent, while the consumer discretionary sector was the market’s worst performer, with a 3 percent decline. The financial sector was the best, with a 23 percent gain.

One thing that’s clear is that the best performers don’t stay on top for long – and there’s a lot of movement between the best- and worst-performing sectors. In a number of years – for example, 2007 and 2008 – the year’s best-performing sector was the previous year’s worst-performing sector.

Use this sector rotation strategy

We back tested this strategy for Asia’s stock market sectors: Buy only the worst-performing sector of the year at the beginning of the following year (for example, buy the worst-performing sector of 2009 as of the first day of trading of 2010), and hold it for a year. Do the same thing at the beginning of the following year, and so on.

As shown in the graph below, over the past ten years this strategy has outperformed the Bloomberg World Asia Pacific Index by a huge margin: It’s generated an average annual return of 13 percent, compared to 6 percent for the index.

In 2016 alone, the worst-performing sector in 2015, energy, was the second-best performing sector. While the index was down 2 percent, the energy sector was up 5 percent.

So what does this mean for 2017?

The worst-performing sectors in the Bloomberg World Asia Pacific Index in 2016 were the utilities and health care sectors. They were both down 9 percent, compared to the 2 percent decline in the index (and a 7 percent return for materials, the index’s best-performing sector).

Does this mean that health care and utilities will perform well this year? History shows that investing in last year’s poorly performing sectors generally makes sense. If you’d want to follow this, the Mirae Asset Horizons S&P Asia Ex Japan Healthcare ETF (which is traded in Hong Kong, ticker: 3153) would be an easy way to invest in Asia’s health care sector, although it excludes Japan (and Japan is part of the Bloomberg World Asia Pacific Index). (The ETF is small and thinly traded, however.)There is no similarly simply way to invest in Asia’s utilities sector. Buying a basket of the largest utilities companies – which include CLP Holdings (Hong Kong Exchange; ticker: 2); Korea Electric Power Corp (Korea Exchange; ticker: 015760); and Hong Kong & China Gas Co Ltd (Hong Kong Exchange; ticker: 3) – would be one (expensive and difficult) way. These three stocks comprise only 13 percent of the utilities sector of the Bloomberg World Asia Pacific Index.

Kim Iskyan

This is a guest post from Kim Iskyan, publisher of Stansberry Churchouse Research, an independent investment research company based in Singapore and Hong Kong that delivers investment insight on Asia and around the world. You can also follow them on Twitter @stchresearch .