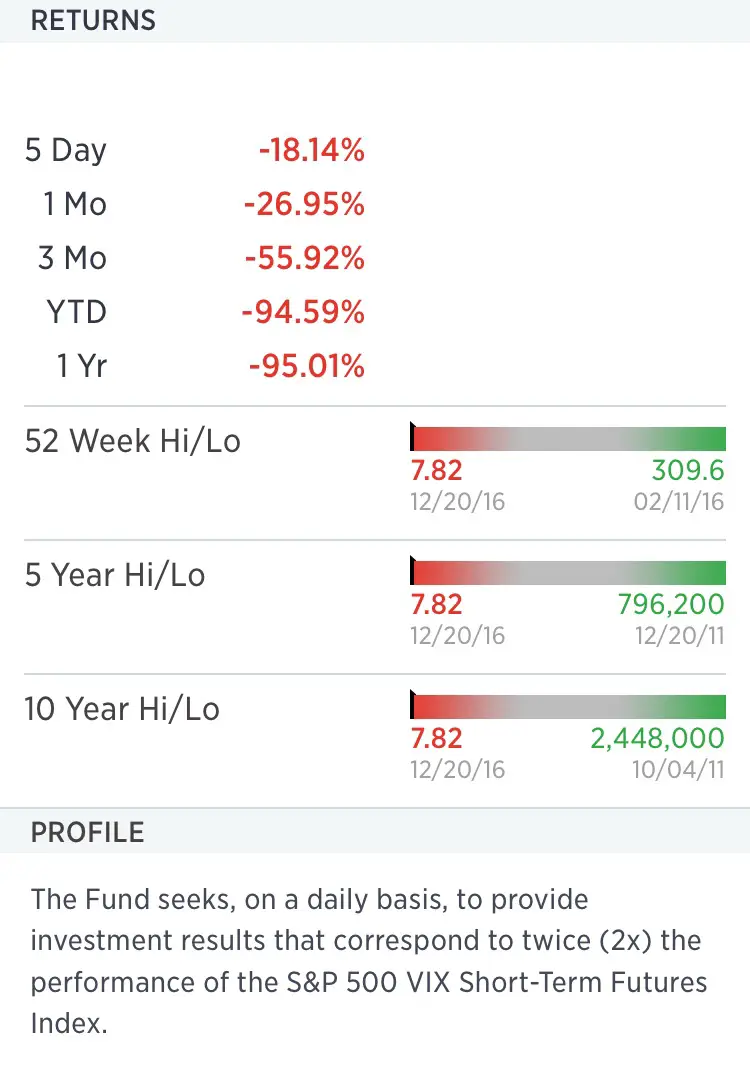

The $UVXY ETF started trading in October of 2011 and it seeks a return that is 2 times the return of the VIX on a daily basis. Due to the compounding of daily returns, the $UVXY’s returns over periods other than one day will be very different than just holding double the $VIX due to leveraged compounding. Due to the nature of the trends in volatility with the market moving from high volatility to low volatility in cycles combined with leverage this ETF has just been crushed over the past five years from a split adjusted high of $2,448,000 a share in it’s first year of trading to just $7.64 in after hour trading today. $UVXY is down 94.59% in 2016 so far. While it is not the Holy Grail of trading it is a great trading vehicle to incorporate into a short side biased trend trading system or sell call credit spreads on. $UVXY does rally when volatility expands and can go up fast in a very highly volatile market like there was in 2008 and again in 2011 but eventually it does self destruct. Rob F. Smith is the trader that first explained this tendency for self destruction of the $UVXY ETF and it is so bad he calls it $UGLY. Rob is a master of trading this beast as well. Looking at the past trading range and historical charts was truly eye opening. It is possible to trend trade volatility itself and benefit from the destruction of capital in a leveraged ETF. Truly the biggest winning short play of the last five years from over $2,448,000 to $7.64 is ten times greater than a reverse Berkshire-Hathaway.

Estimated UVXY Reverse Split Number 7—January 12, 2017