This is not a prediction it is just a list of things to look for as possible signs before a market rolls over. Alone these are just possibilities but the probabilities increase as more of the signs are in place. These signs do not mean that the market could crash just that it can pullback to near term support or go from a trending market to a market that can be actively traded. Currently this is a trend followers market where you just buy and hold on.

Here are simply signs that the market could see a short term top and then need consolidation in a range before trending higher.

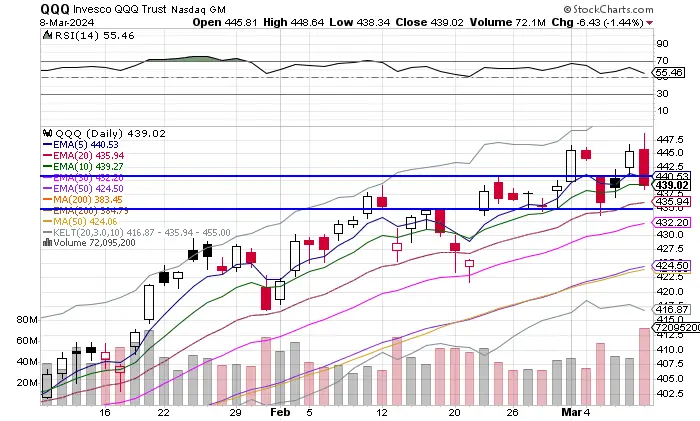

- When the chart reads far over the 70 RSI on the daily chart for a stock index. The 90 RSI is one of the most overbought stock index readings I have ever seen in any market.

- A shooting star Doji candlestick with an island reversal pattern.

- If the market opens higher but fails to go over the opening price level for the entire trading day, this is a sign that buyers are rejecting higher prices.

- The market opens below the previous days trading range and never gets over the previous days low, that is an early sign of a new trading range.

- The market starts to open higher but closes lower, that is a sign of distribution.

- The average daily trading range increases and volatility starts to grow. $VIX finds a bottom at 12 and starts trending back up.

- A huge volume day that gaps way up and then sells off into negative territory on high volume. This could be an exhaustion top.

- A price index is extended over two ATRs from the 10 day EMA moving average.

- A major “good news” event is passed with little up movement, and the market is out of catalysts.

- When the majority of traders and investors are completely bullish and you can not find anyone that believes we are near a top.

- A major magazine runs a stock market bull on its cover.

- A major magazine starts predicting a big index price level.

These are just things to look for going forward and could result in nothing more than a pullback to a short term moving average or a new range being traded. There are times to buy a breakout and times to wait for a pullback. There is a fine line between chasing the market higher and buying momentum. Trading is all about your risk/reward on entry. Long term your stop loss versus your price target determines profitability. It is difficult to see how there will not be a pullback to buy soon before we go much higher.

Trees don’t grow to the sky and planes don’t fly to the moon. There is always opportunities to get on board at some point.