Skip to content

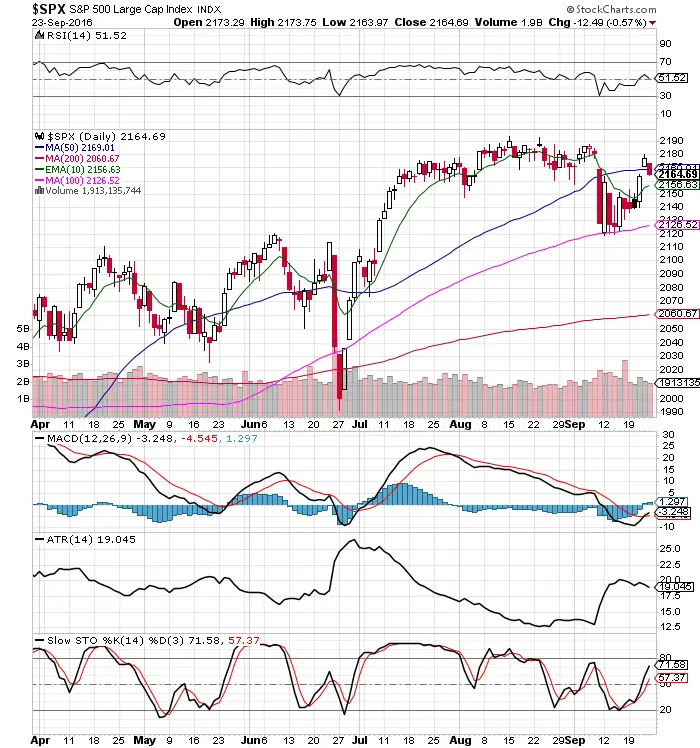

Chart Courtesy of StockCharts.com

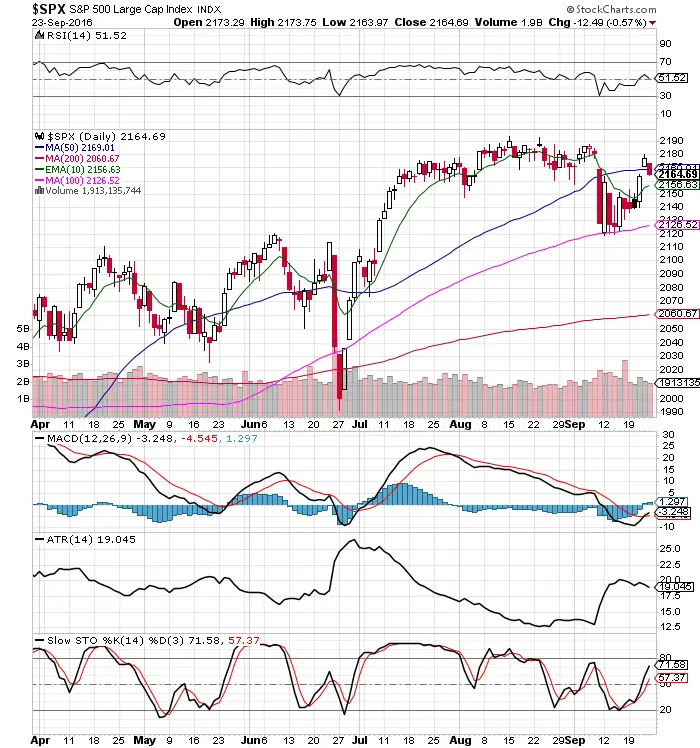

Chart Courtesy of StockCharts.com

- SPX continues in a range with resistance holding at 2200 and support at 2120.

- SPX new all time highs stays within striking distance and is still possible in coming weeks.

- The SPX 100 day SMA held as key support during the last plunge.

- The SPX MACD finally had its first bullish crossover since June.

- Slow Stochastics maintains a bullish crossover.

- RSI neutral here at 51.52.

- The FED keeping rates steady led to the two day bounce.

- The 50 day SMA did not hold as SPX support on Friday.

- Price got over one ATR extended from the 10 day EMA before the pullback and price could return to the 10 day EMA.

- We stay in a trading range where buying deep dips and selling multiple day rip upwards continue to be rewarded with profits.