This is a guest post from Dante Vincent

I was having a discussion with one of my guys the other day…he saw some others in the room making some really nice trades, and he said to me “Dante, what are they doing that I’m not doing?” Putting in the time outside of market hours…in addition to screen time. Going the extra mile. I told him he needed to be more dedicated and put in more time – and his response was simple, and fairly logical when taken in context, he said: “Put in work how? I don’t know what to do.” And at first I was frustrated with that response…but after contemplating it for a minute, it made perfect sense for him to say that. If you are a newer trader, the market is a very scary, fast moving and overwhelming place. Everyone tells you to “go find your niche” but they don’t really tell you how to do it. Just that you have to do it. “Figure out what you’re good at, and then go through charts every night, seeking out your strong setups, and study them. See which ones worked, which ones didn’t, and why. Was it news that stopped that breakout from following through? Was it volume? Was it the overall market conditions?” Asking those type of questions.

So how are you supposed to do that? Yes some will figure it out for themselves (1/10) traders, but the rest run out of money before they ever get the chance to unfortunately. If the other 9/10 just had some more early guidance, there could have been some additional success stories in those guys who failed. I’m writing this today to give you my best advice on a quick and easy method to finding your niche, and something that helped me personally as well.

Don’t have any idea where to start regarding what types of setups to trade? Perfect. You’re an ideal candidate to benefit from this suggestion. My advice to you is this: Go crazy. Trade them all! But trade them with MICRO size… 50-100 share lots at most. Small enough that you can make a good amount of mistakes and not get too badly hurt financially.

Where am I going with this? Glad you asked.

I’m sure at some point someone’s suggested to you “keep track of your trades and review your performance.” And they’re correct, but you need to do it efficiently. Work smarter, not harder. If you spend 2-3 hours reviewing your trades at the end of the day saying “oh I could have done this better or I should have done that sooner” etc then that’s good…but more times than not probably after you’re done reflecting, your favorite TV show comes on or something else distracts you, and most of the thoughts you just had go right out the window. So what did you really accomplish? Not much. You need to be extracting information from your trades, just mentally “reviewing” them is not enough. Get some visuals.

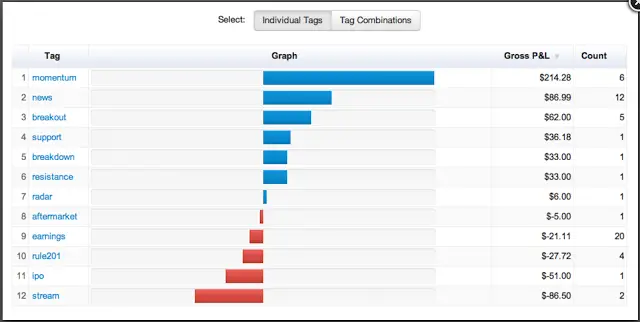

There is a fantastic trading journal program called TraderVue. And I highly recommend you try it. It has a number of great features, one of my favorites being the Tag feature. When you upload all of your trades from the day onto the journal, you can put a tag on each one, and TraderVue will compile a running bar graph analysis of those tagged trades in an easy to use, compartmentalized fashion. I don’t really know of any other trading journals as I don’t use one anymore myself, but if you have a different or better option then by all means use that, just get something that has the “tag” feature when you can organize all of your trades and see a nice graph of whats going on.

Some example tags would be “Morning Parabolics”, “VWAP rejections”, “After 10:30 VWAP holds”, “HOD Rejections”, “Falling Knives”, “Buyer Exhaustion”, “Seller Exhaustion”, “Daily Resistance Fail”, “Failed follow thru momentum”, “Gap and Gos”, “Lull trades”, you get the idea. If you’re ever unsure of how to categorize one of your trades, send it to me via DM on Twitter @DGTrading101 and I’ll figure it out with you.

Create all these tags, group your trades each day into their respective categories, and just go through that process for a couple weeks. Let the data set start to accumulate and mature, and your TraderVue chart will begin to take form and look like this:

How is this useful? You literally don’t have to go “find” or guess your niche – it will reveal itself to you in the form of cold hard facts. Men lie, women lie, Top Tick Luke lies, ProTrader Mike lies, but numbers don’t lie. This will tell you exactly what’s going on under the hood – where you’re making money, and where you’re not. It’s essentially a graph of your strengths and weaknesses. Listen to it. There’s a directly inverse relationship that should develop here through this exercise: As your Tag chart data grows, the types of trades you take each day should be narrowing. Make sense? If you do this correctly, you will successfully arrive at the destination: your niche.

If you “love to trade morning parabolics because they’re exciting and fun”…but your TraderVue graph has a big fat red bar next to the Morning Parabolic tag from all the money you’re losing by trading them, then guess what? You need to stop trading morning parabolics! It doesn’t get any more black and white. Don’t overthink it. Don’t trade a setup because you like it and it’s “fun & exciting” or because you see someone else having success doing it, trading is not supposed to be fun. It CAN be fun…but first and foremost it’s a job. A way to make money & extract capital from the emotional and impatient traders who are too lazy to do things like we just discussed.

The beauty of trading is that 1000 different people can employ 1000 different methods, and all make money on any given day. Everybody is different – your personalities, your mind, and the way you process & react to certain trading setups is completely unique to YOU. You can’t say “Oh..this guy really nails this type of play, so I’m gonna follow him and try to learn that.” No. Good for that guy, but he’s not you.

So now that you’ve got some concrete visual reflection of your actual trades to work with, you can use that chart to guide you. When you do your chart work at night, specifically seek out examples where your strengths played out that day – and dive into that chart to see why it worked. Gravitate towards the setups that are making you money, seek them out each market day, and eliminate the ones that aren’t. I know that sounds obvious…but it’s really that simple in my opinion. Yet 9/10 traders neglect to do this and is largely responsible for why they fail to find consistent success.

But you’re going to be smarter than that. You got this. Get er’ done.

Any additional questions about anything, feel free to e-mail me at [email protected]

Dante

Posted by Dante Vincent at 8:02 AM

Original Post The Mind of a Day Trader