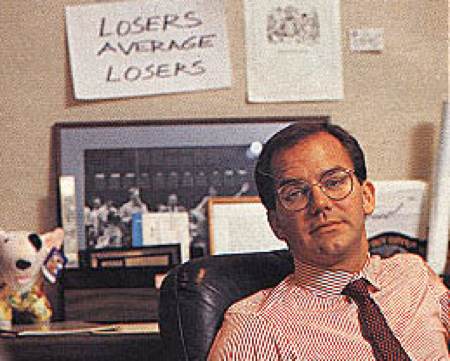

“Don’t ever average losers.”

When a trade is going against you it means you are wrong. Adding to a loser just usually makes it bigger and your stress overwhelming.

“Never trade in situations where you don’t have control.”

Getting into a trade that you can’t easily get out of is a dangerous trade in itself. Liquidity risk, headline risk, and volatility can be dangerous when you are at their mercy.

“If you have a losing position that is making you uncomfortable, the solution is very simple, Get out.”

Many times exiting a trade is the easiest way to stop a losing trade from getting worse, managing stress, or freeing up capital for other uses. You can always get back in.

“Don’t be too concerned about where you got into a position.”

All that matters about your current positions is what you should do now based on the current price action not your cost basis or entry level.

“The most important rule of trading is to play great defense, not great offense.”

Trading offensively is trying to grow you capital while defense is protecting what you have. Winning trades are how many points you score and losing trades is how many points you give up to the other team. While offense is great for a show defense wins championships.

“Every day I assume every position I have is wrong.”

Mental flexibility is the ultimate effective habit of successful traders. Being willing to accept that a trade is wrong will lead you to cut losses fast, keep losers small, and lose your opinion not your money.

“Don’t have an ego. Always question yourself and your ability.”

Being over confident and arrogant leads to trading too big and staying on the wrong side of a trend for too long. Most account blow ups and ruin comes when a trader believes they are smarter than the markets and stay with their strong convictions after being proven wrong.