Top Trading Tweets of the Week 10/9/15[/caption

Top Trading Tweets of the Week 10/9/15[/caption

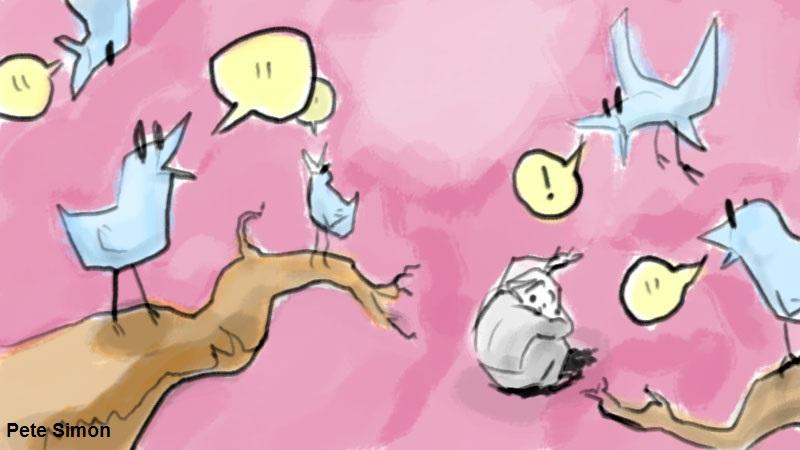

investors (pictured below) react to the Fed minutes pic.twitter.com/WP2JxCiWkD

— StockCats (@StockCats) October 8, 2015

"the market can stay overbought longer than I can remain sober" – old Wall St. saying

— StockCats (@StockCats) October 9, 2015

One thing that made me successful is the ability to realize and accept that i make mistakes. Then try to learn from them vs making excuses

— Modern_Rock (@modern_rock) October 8, 2015

Dear Ben Bernanke: here you go http://t.co/07518TlEDr pic.twitter.com/PuPiwNvAFI

— zerohedge (@zerohedge) October 8, 2015

"If you don't make it at Tesla, you go work at Apple."

- Elon Musk

Shots fired. https://t.co/B4hJmNpPGG

— Downtown Josh Brown (@ReformedBroker) October 9, 2015

Trading + No Patience = No Money…Have a good evening

— DK1 (@canuck2usa) October 6, 2015

It's not just about making winning plays it's more about keeping the $ after you win- dont let a winner become a loser #MentalCost

— DK1 (@canuck2usa) October 6, 2015

Trend following is reactionary, not predictive, & is therefore no more a form of market timing than value investing https://t.co/YmLglaHber

— Jerry Parker (@rjparkerjr09) October 5, 2015

The top 3 factors that motivate the majority of institutional investment decisions:

1. Career risk

2. Career risk

3. Career risk

— Ben Carlson (@awealthofcs) October 8, 2015