“The key to long-term survival and prosperity has a lot to do with the money management techniques incorporated into the technical system.” -Ed Seykota

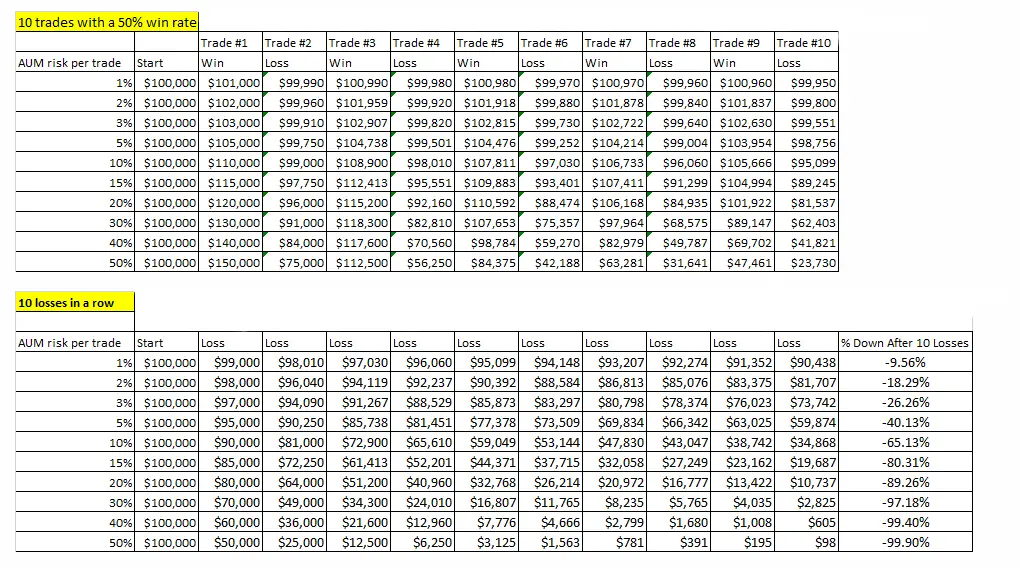

The above image shows the destruction of capital, not only for a losing streak, but also for a string of 10 trades with a 50% win rate; alternating between wins and losses.

Many things cause new traders to fail. One of the main reasons that traders fail is because they don’t understand the math of capital destruction. The more capital you risk per trade, the quicker you will lose it in losing trades. Once your capital is depleted, it takes a larger return to get back to even than what you initially lost.

- A 10% loss requires an 11% return to get back to even

- A loss of 20% of your capital requires a 25% return to get back to even

- A 50% loss of capital needs a 100% return just to get back to where you started

- Risking 1% of your capital per trade puts you down 10% after 10 trades

- Risking 5% per trade puts you down 50% after 10 trades

No matter how good you are, you can’t trade so large that a single losing streak is your last. If you risk too much of your trading capital, even a few losses in a 50% winning streak will destroy your capital. You’re not going to be perfect as a trader, and you have to play the defense needed to protect your trading account from losing streaks. You will have streaks of 50% win rates and losing streaks. The question is, will you survive them with your current risk exposure.

You have lost money trading because you exposed your capital to too much risk in a single trade. You haven’t been profitable because your losses have destroyed your capital. You have to structure your position sizing so your losses don’t destroy your capital after every losing streak.

“This idea that in order to make a decision you need to focus on the consequences (which you can know) rather than the probability (which you can’t know) is the central idea of uncertainty.”

― Nassim Nicholas Taleb