Skip to content

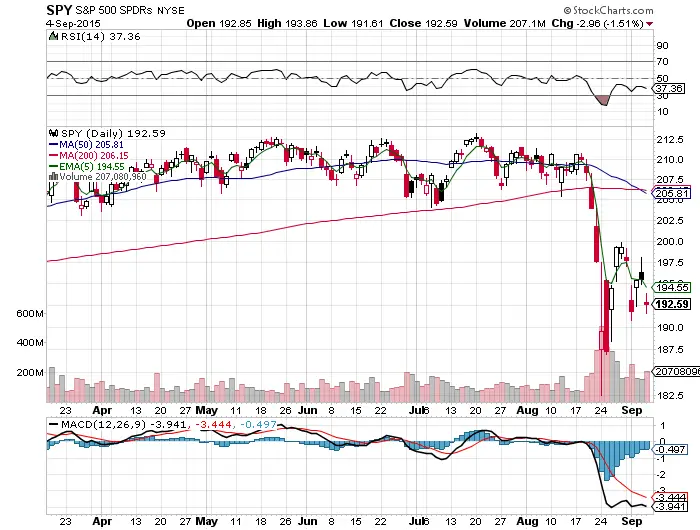

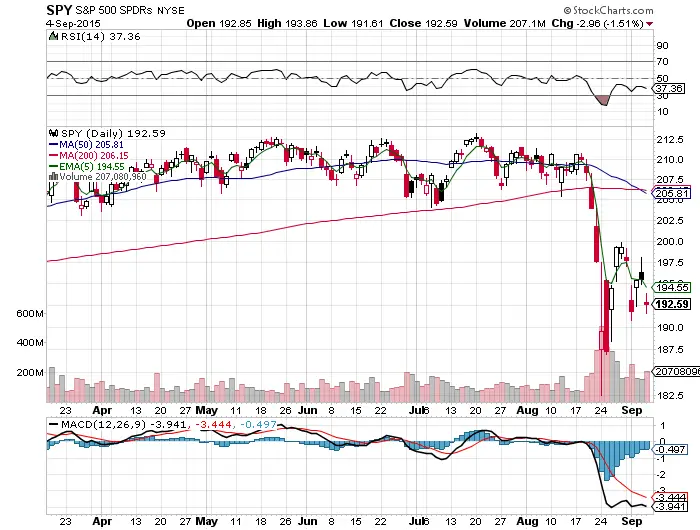

- The market is still in bear territory under the 200 day simple moving average.

- The MACD is extremely bearish, showing a lack of momentum.

- Up days continue to be on lower volume and down days on higher volume, which shows distribution.

- A 27.80 $VIX is not bullish, it demonstrates uncertainty.

- The RSI is weak at 37.36 with a potential bounce at the 30 RSI.

- The 50 day/200 day death cross is rarely bearish, but when it is, it precedes a large plunge 1 in the last 5 times.

- The 50 day SMA is sloping downward, which is bearish.

- Leading stocks are not making higher highs,. Instead they have broken down out of bases and uptrends.

- Momentum is being sold and not bought.

- Bad things happen under the 200 day SMA; flash crashes, sell offs, volatility, and plunges are all possible.