In baseball, you don’t have to swing at every pitch. And in these markets, the best traders wait for the best signals. Good batters look for the pitches over the plate, the ones they can knock out of the ballpark. Good traders look for high probability setups with great risk/reward ratios.

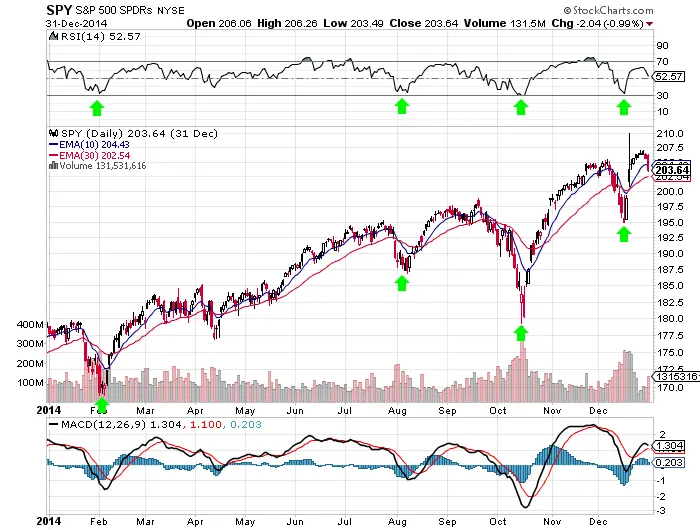

With the RSI oscillator, the the best dip buying signals I have found in stock indexes and stock sectors are near the 30 RSI on the daily chart. Price generally bounces and closes over the 30 RSI in indexes and sectors due to the built in need to purchase stocks by mutual fund managers, corporate buy backs, and investors looking for low price opportunities. The $SPY is one of the best trading vehicles to buy near the 30 RSI for an initial bounce of at least a day or two. One good target is the 50 RSI.

In a bull market, the 200 day is the line that separates the bulls from the bears. Many trend following systems start selling longs and getting short if the 200 day is lost. The first move to the 200 day usually creates big sustained bounces in price. This is a high probability buy level with a great risk/reward ratio, inside a long term uptrend in a bull market. This line is considered a pullback.

If the 30 RSI and the 200 day end up converging, it sets up a great dip buying opportunity and a potential short term reversal back to the 50 RSI, or even all time highs. Greece may provide the catalyst to get us down that far as fear invades the price action.

Greece’s economy is the size of Boston or Connecticut, it will have little effect on the earnings of the companies in the S&P 500 or their prices long term. Much of this sell off is the fear of counter party risk and the danger to the EU staying together. With the high levels of fear and the volume of put purchases, many are on the sidelines waiting for a resolution before they buy back in. I am going to buy when given the opportunity at these levels.

I would be a buyer of $SPY via $SPXL if it take takes us back over the edge and down to the 30 RSI/200 day SMA area.