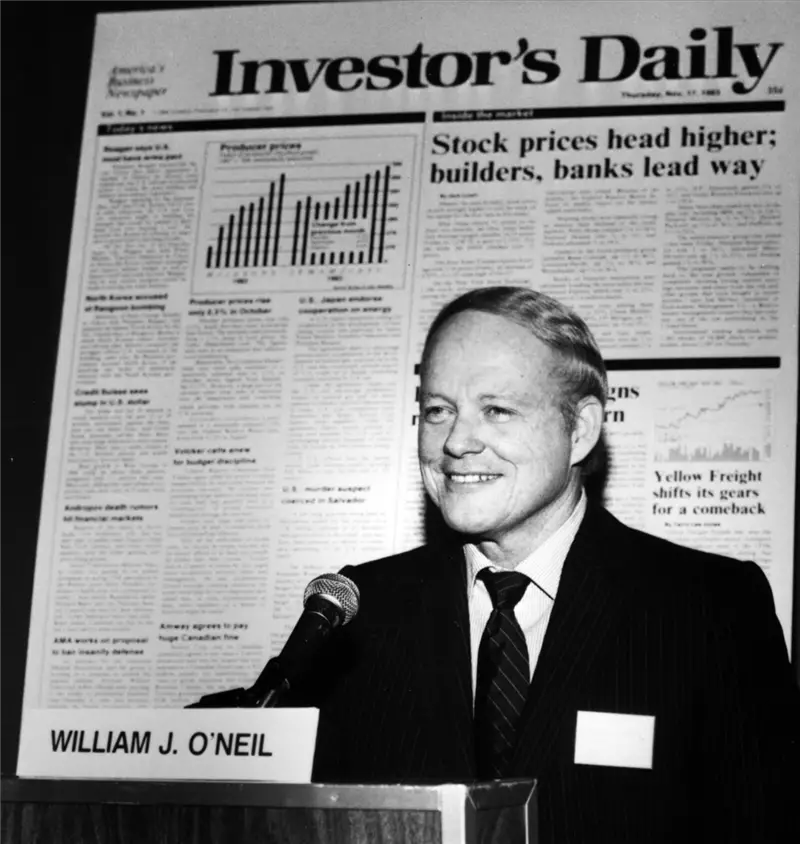

The late William O’Neil is likely one of the greatest stock traders of our time. O’Neil made a large amount of money while he was only in his twenties, enough to buy a seat on the New York Stock Exchange. Today, he runs a successful investment advisory company to big money firms, and is also the creator of the CAN SLIM growth investment strategy, which the American Association of Individual Investors named the top performing investment strategy from 1998 to 2009.This non-profit organization tracked more than 50 different investing methods, over a 12 year time period. CANSLIM showed a total gain of 2,763% over the 12 years. The CAN SLIM method is explained in O’Neil’s book “How to Make Money in Stocks”.

Mr. O’Neil founded “Investor’s Business Daily” to compete directly with “The Wall Street Journal”, and he also discovered of the “cup with handle” chart pattern.

Those closest to O’Neil that have seen his private trading returns say that they are greater than Warren Buffett’s or George Soros over the same time period. Here are some of the principles that lead to his results, and why he is considered a trading legend.

#1 He sells a stock he is holding after it has gone down 7% from his purchase price.

“I make it a rule to never lose more than 7 percent on any stock I buy. If a stock drops 7 percent below my purchase price, I will automatically sell it at the market – no second-guessing, no hesitation”

#2 One of the major keys to his profitable trading was only having small losses when he was wrong.

“The whole secret to winning in the stock market is to lose the least amount possible when you’re not right.”

#3 William O’Neil studied historical chart patterns relentlessly and read thousands of trading books.

“90% of the people in the stock market, professionals and amateurs alike, simply haven’t done enough homework.”

#4 He invested in an industries leading stocks not its laggards and dogs.

“It seldom pays to invest in laggard stocks, even if they look tantalizingly cheap. Look for, and confine your purchases to, market leaders.”

#5 O’Neil ‘s investing style lead to big winners and small losing trades.

“Investors cash in small, easy-to-take profits and hold their losers. This tactic is exactly the opposite of correct investment procedure. Investors will sell a stock with profit before they will sell one with a loss.”

#6 He did not waste his time and money playing the short side in bull markets.

“Cardinal Rule #1 is to sell short only during what you believe is a developing bear market, not a bull market.”

#7 Fundamentals told O’Neil what to buy and the chart told him when to buy.

“The number one market leader is not the largest company or the one with the most recognized brand name; it’s the one with the best quarterly and annual earnings growth, return on equity, profit margins, sales growth, and price action.”

#8 O’Neil knew exactly what he was doing in the markets. He had a trading plan, trading principles, and rules.

“Some investors have trouble making decisions to buy or sell. In other words, they vacillate and can’t make up their minds. They are unsure because they really don’t know what they are doing. They do not have a plan, a set of principles, or rules to guide them and, therefore, are uncertain of what they should be doing.”

#9 O’Neil traded price action not his own opinions or of anyone else.

“Since the market tends to go in the opposite direction of what the majority of people think, I would say 95% of all these people you hear on TV shows are giving you their personal opinion. And personal opinions are almost always worthless … facts and markets are far more reliable.”

#10 He watched a stocks volume as part of his trading plan.

“The best way to measure a stock’s supply and demand is by watching its daily trading volume. When a stock pulls back in price, you want to see volume dry up, indicating no significant selling pressure. When it rallies up in price, you want to see volume rise, which usually represents institutional buying.”