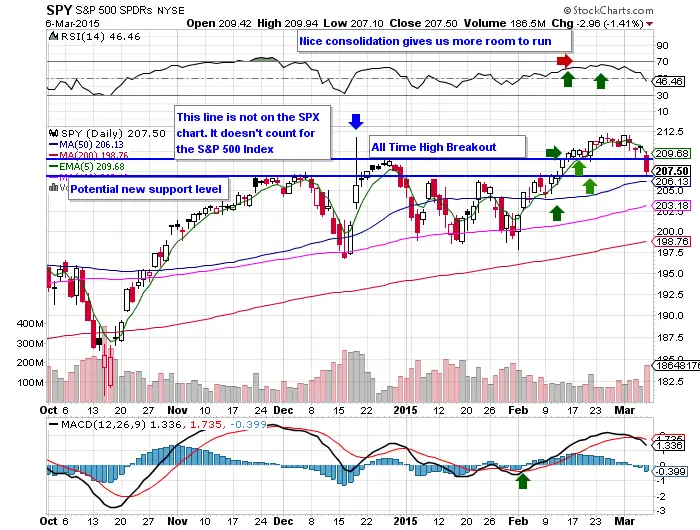

Chart courtesy of stockcharts.com

- The long term uptrend is still in place.

- $SPY pulled back and found support on the previous all time high breakout from late 2014. (This resistance/support line has been on my chart for weeks. It was not drawn this morning).

- There was a bearish MACD cross on Thursday that was confirmed by the drop Friday.

- The RSI dropping below the 50 RSI puts us on the weak side of the RSI line and shows the loss of momentum for now.

- The fact that the stock market sold off so strongly on the great job numbers is something to watch out for as a change of market dynamics. Price will have to confirm with the inability to make new highs.

- The odds here favor a pullback after the recent run.

- The key bounce zones to watch is first the 50 day sma.

- If the 50 day is lost then the 100 day sma or the 30 RSI zone would provide a great risk/reward ratio trade set up.

- This is currently just a normal pull back with an old breakout becoming a new support level.

- If you want to sell short then realize downtrends are more difficult because they are more volatile and have many false rallies back to old resistance.