The principles that successful trend traders use to make money in the markets is difficult for the average investor or trader to understand.

Readers unfamiliar with systematic trend trading have a hard time trading for profitability without trying to predict where price will go. Most successful trend traders have preset, planned entries that are triggered by a reaction to a new high or low price being hit. They use quantifiable price levels and indicators like moving averages to know when to enter and exit a trade, and don’t try to guess what will happen next. They buy or sell short in the direction of the dominant trend, and when they get a signal that shows the potential for a trend, they attempt to follow it.

Even though many money managing trend followers have had long term gains over many years, some critics complain that trend traders are prone to large drawdowns. While 20% drawdowns are unpleasant, traders of all types have drawdowns, and many that trade against trends and do not manage risk carefully, blow up eventually. It’s difficult to discount trend followers that have made fortunes with reactive technical systems over the long term.

Anyone who says they can predict the stock market with certainty can’t be trusted. It is delusional to think that they are smarter than all other traders, and that they can see all events that move markets. Trend followers use preset price signals to identify trends, they manage their risk on every trade, and they follow their system with great discipline.

As long as markets trend, then trend-followers will be winners in the zero sum game over the long term.

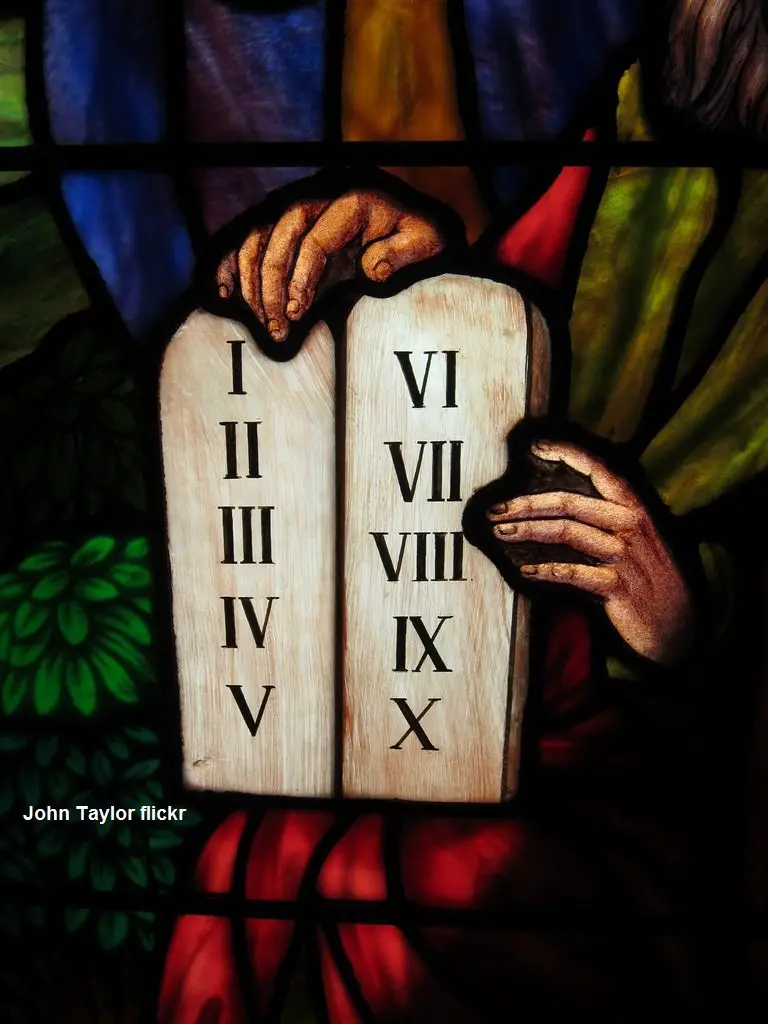

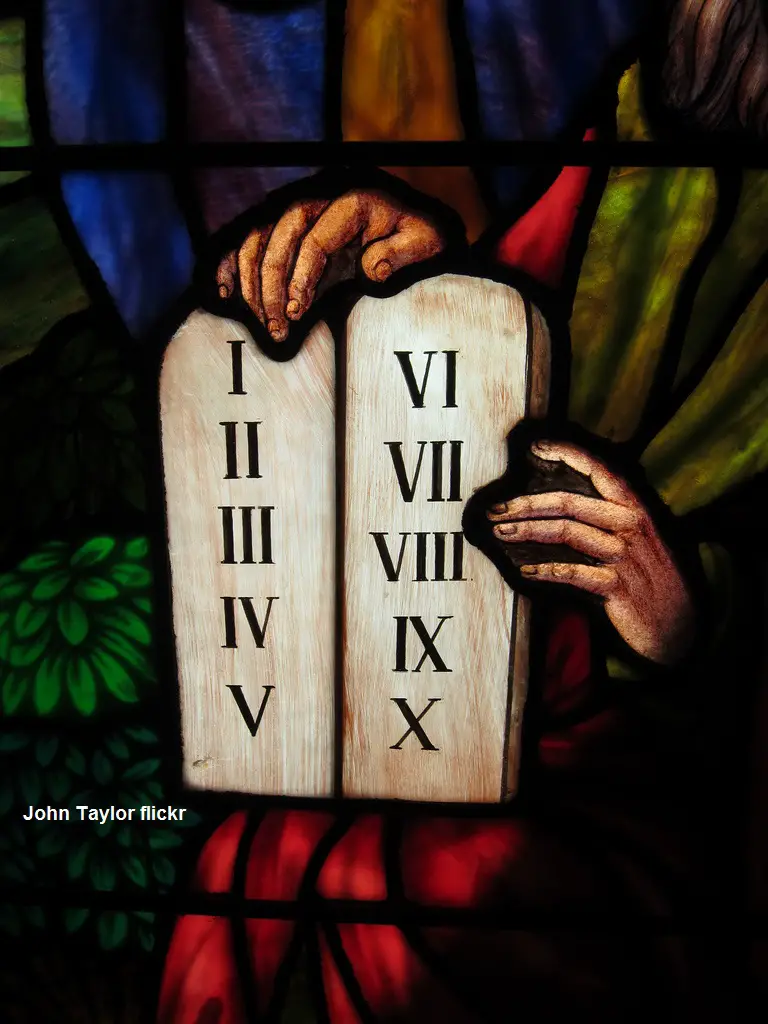

Here are some of the commandments they trade by:

1. You shall back test and develop robust trend trading systems that are profitable over the long term.

2. You shall identify and follow the long term trend in the markets you trade, and have no guru that you bow down to.

3. You shall not try to predict the future, but follow only the current price trend.

4. You shall remember the stop loss to keep your capital safe from destruction, knowing your exit level before your entry is taken.

5. Follow your trend following system all the days that you are trading, so that through discipline you will be profitable.

6. You shall not give up on your trading system because of a drawdown.

7. You shall not change a winning system because you have had a few losing trades.

8. You shall trade with the principles that have proven to work for successful traders: manage risk, go with the trend, and diversify so your days in the market will be long.

9. You shall keep the faith in your trend following system, even in range bound markets; a trend will eventually begin anew.

10. You shall not covet fundamentalist’s valuations, CNBC talking heads, newsletter predictions, Holy Grails, or false claims of any kind.