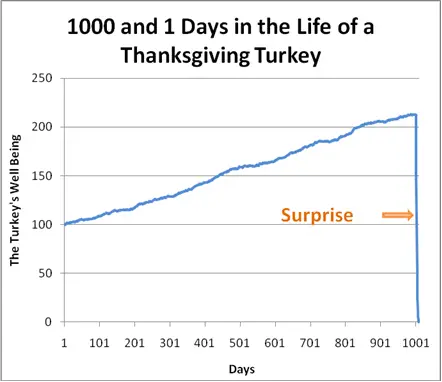

There is a story in the book Anti-Fragile of a turkey that is fed for 1,000 days by a butcher, and everyday, confirms to the turkey and the turkey’s economics department and the turkey’s risk management department and the turkey’s analytical department that the butcher loves turkeys, and every day brings more confidence to the statement. So it’s fed for 1,000 days until maturity. Fatter and fatter. On the day when its comfort will be at its maximum, there is going to be a surprise. There will be a surprise for the turkey. There will be a surprise for the turkey’s economics department, all those Ph.D.’s. But it’s not a surprise for the butcher, is it? Not a surprise for humans. It’s a surprise for the turkey. So the whole idea here is we are not to be a turkey. – Nicolas Taleb (Charlie Rose Interview)

Traders can fall into a complacency trap when making consistent money, using a particular system or method. As they continue to win, and their confidence grows, they can start to trade larger position sizes—soothed by their own success, these retail investors and money managers may lose site of the nature of the markets.

Success during a certain type of market environment does not equate to trading skill.

When the trader is at the peak of their confidence, and has their largest position size, is usually when the top is in. The market will suddenly change, and the system will fail. Whether it is a single day of ruin, or it takes a year or more, this is when the inexperienced or arrogant trader begin to give back profits that were gained in a climate of randomness and luck. The traders that embrace risk management and remain flexible to the markets will always come out ahead in the end.

Don’t be the turkey.