-

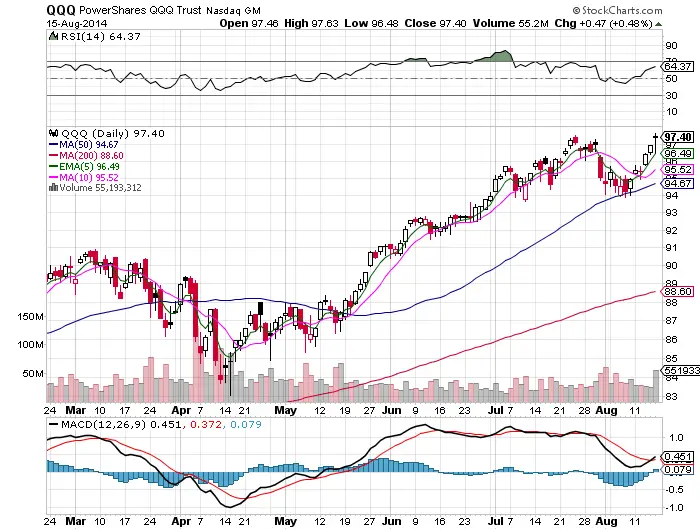

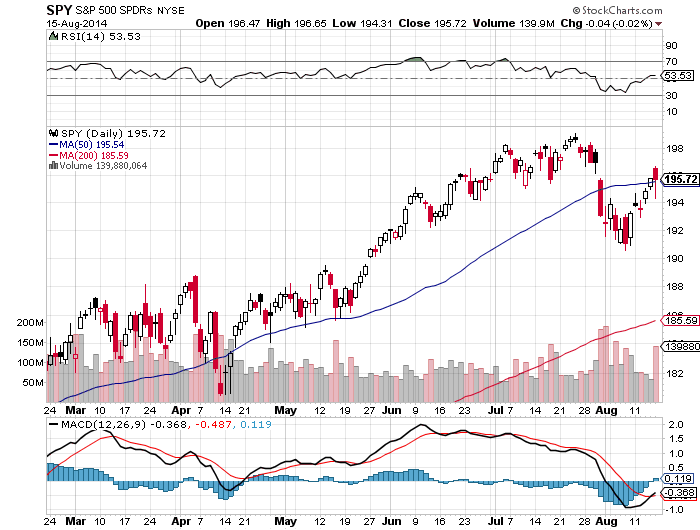

Friday bounces back above all key support levels. $QQQ 5 day ema, $SPY 50 day, $IWM 200 day, and $DIA over the 100 day. By the end of the day the support did hold.

-

Buyers stepped in to buy even after all the geopolitical risk escalated on the Ukraine news about the destroying of a Russian convoy column. Failing to stay down with all the fear on Friday is a bullish sign.

-

This market has a lot of momentum and is pulling away from short term moving averages which is usually the sign of a strong up trend.

-

A big reversal day like Friday generally holds and the trend up continues.

-

$QQQ & $SPY both over their 50 RSIs and $IWM & $DIA almost in the bull half of the RSI chart. There is still plenty of room to advance with out becoming overbought after the recent bounce.

-

Many leading stocks still holding up very well. examples: $FB $GOOGL

-

Best of the Stock Universe

-

100 of the Strongest Stocks

-

Stocks bouncing off their 50 day lines

-

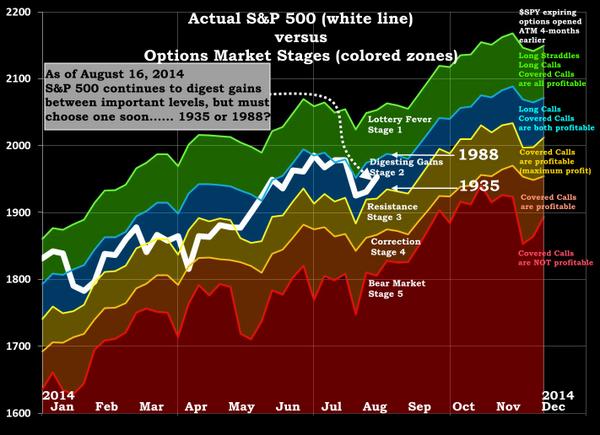

S&P can’t stay here, and must choose 1935 or 1988 soon. Details Sunday 8am New York (EDT) http://www.zentrader.ca/blog/