-

Rallying on Friday in spite of all the overwhelming bad news of bombing in Iraq and Putin threatening Ukraine is a positive signal for bulls. If that news can’t take the market down, what can?

-

Last week all support levels held and prices bounced, this is what you would expect for the long term uptrend to stay in place.

-

$INDU near term support is the 200 day sma, resistance at the 100 day.

-

$SPY near term support is the 100 day sma, resistance at the 50 day.

-

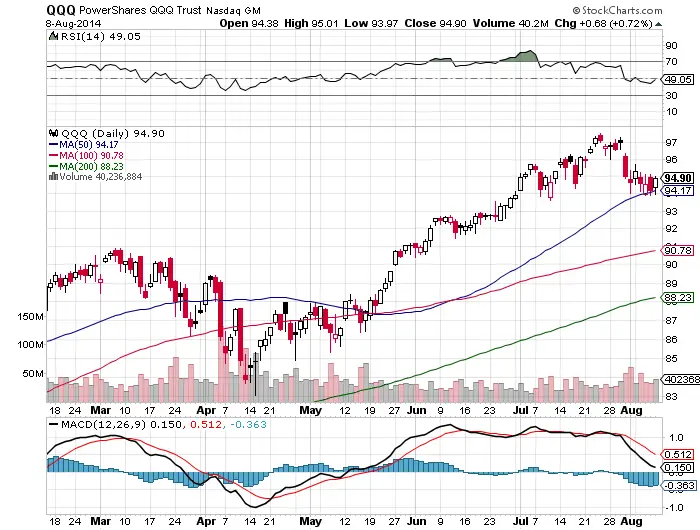

$QQQ near term support is the 50 day sma, resistance is at $95

-

$IWM near term support is the 30 RSI, resistance is at the 200 day.

-

Closing below or above any of these areas is the first sign of a potential break of the range into a trend for the stock market from these levels.

-

The risk/reward here favors an up trend at least to near term resistance.

-

100 of the strongest stocks

-

Top Stocks in the UNIVERSE as of 08/09/2014

Mortar has not had time to set on brick wall near 1980s S&P…. yet. Details http://t.co/svYaiUVPAS Sunday 8am EDT. pic.twitter.com/oNYtYjyoK0

— Christopher Ebert (@OptionScientist) August 8, 2014