-

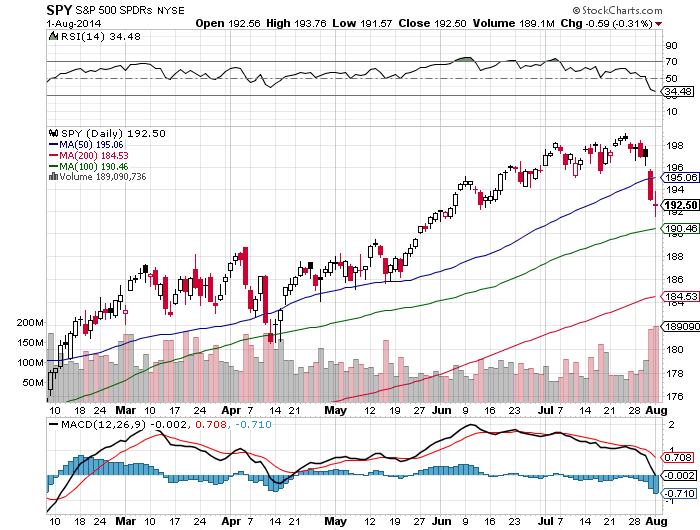

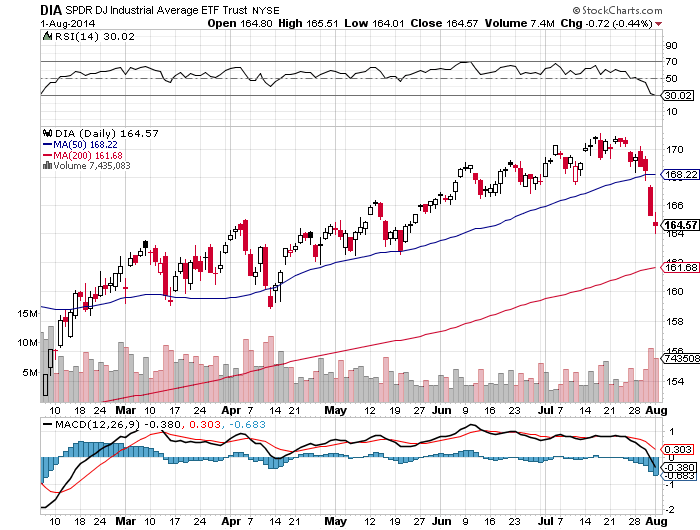

The $DIA, $QQQ, and $SPY are still in long term up trends so far.

-

Only $IWM has broken the long term uptrend by closing below the 200 day. $IWM has been the weakest index and $QQQ has been the strongest.

-

$SPY bounced near the 100 day and 30 RSI Friday.

-

$DIA and $IWM did not close below the 30 RSI Friday and are inside a high probability bounce zone. (I am long both of these going into Monday, I entered $IWM on Thursday and $DIA on Friday, my stop loss is a close below the 30 RSI).

-

$IWM first high probability resistance area will be at the 200 day if it rallies next week.

-

This is still a buy weakness sell strength market. Momentum and break out strategies to the upside are not profitable here.

-

The $FB gap and go failed last weak making lower highs and lower lows day and losing the low of day gap up.

-

The risk/reward favors being long here. This is a deep hole to short into and would be after the fact based on my market model.

-

Top 100 Stocks

-

50 Day Bouncers

-

Buy The Dip Is Now Sell The Rip

-

Stock Ready List as of 08/02/2014