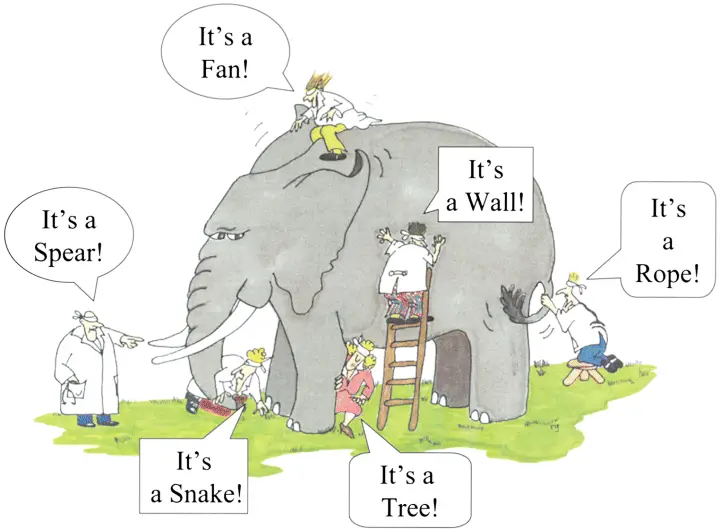

There is an old parable known as “the blind men and the elephant.” In this story, there are four blind men who are asked to determine what an elephant looks like. The first blind man feels the leg of the elephant and says, “The elephant is like a tree because it is large and round like a pillar.” The second man feels the tail and says, “The elephant is like a rope because it is small and coarse.” The third man feels the ear and says, “The elephant is like a fan because it is flat and thin.” The fourth man feels the trunk and says, “The elephant is like a snake because it is long and curves.”

A king comes to the four blind men and says, “all of you are correct.” The king goes on to explain that each one had drastically different descriptions of the elephant because they are all feeling different parts. So, they are all correct. The elephant has all the features described by the four blind men.

This parable is a good analogy describing different types of profitable traders. Many of the arguments that erupt between traders on social media are due to not understanding the others time frames or not understanding the other trader’s position sizing, stop loss level, or expected winning percentage. Also too many cult members of Elliot Wave, Trend Following, Market Profile, Day Traders, and option traders etc. think their way of trading price action is the only way when their way is only one of many paths to profitability. There are as many ways to trade price action to be profitable as there are profitable traders.

The elephant in the room is that profitable traders do a few things in common:

- They manage their losses to keep them small regardless of their winning percentage.

- They trade position sizes that bring their potential risk of ruin through a string of losses to virtually zero.

- They are an expert in their own profitable strategy.

- Their emotions are not used in trading decisions.

- Their ego does not pick position sizing, entries, or exits.

- They go with the flow of what is actually happening not what they want to happen.

- They trade a robust methodology.

- They do the work required to be successful.

- They are comfortable with what they are doing.

- Their trading fits their risk tolerance and personality.

Many profitable traders only see the aspects of the markets that make them profitable. Seeing the full dynamics of the markets and all the opportunities to make money is a step toward enlightenment.