While all of these may not fit into your own trading plan, some of these rules could help individuals decrease drawdowns.

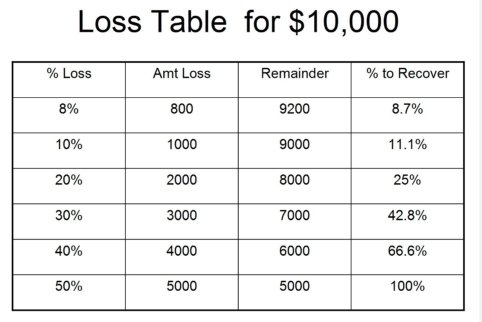

- Make limiting your drawdown in capital your number one priority, not your profits. It is much easier to be profitable when you don’t lose a lot of money.

- Never lose more than 1% of your total trading capital on any one trade.

- Do not overexpose your account to too many positions that are all closely correlated to the same trend.

- Only take your highest probability entry signals.

- Only trade one to three open positions at a time, so even big whipsaws in price action do not damage your account too much.

- Only trade markets you are very familiar with, and have done excessive research on with charts and backtests.

- Trade smaller and smaller during losing streaks, and only get back up to full size during winning streaks.

- Use option contracts to cap possible maximum losses to only the contract size.

- Do not become biased as a bull or a bear. Be open minded to what the markets and your signals are saying about the current trend.

- Trade only a method you fully understand, and do not piggy back on another trader.