-

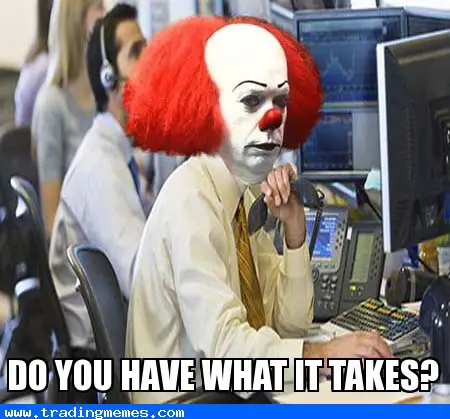

They say things like “I have been pounding the table on this trade” or want some kind of brownie or cookie for “calling some market movement” it is about making money not wanting to be pet on the head for being “right”.

-

Foolish traders are focused on predicting the future instead of trading what is happening in the present. There are no crystal balls or time machines and the future does not exist until it gets here. Trading signals happen in the present moment foolishness happens trying to predict the future movements.

-

Foolish trades trade so big it doesn’t matter how much profit they make because they will just give it all back eventually. One one loss wipes out the majority of winning trades that is a foolish way to trade.

-

Foolish traders believe in gurus while good traders believe in robust systems, trading plans, risk management, and the right mind set.

-

Foolish traders celebrate winning trades way too much, either they don’t win much or have a lack of control over their emotions.

-

The really foolish trader judges others on just a few trades or a few months of trading performance, trading is a very long term endeavor and success is measured in years not a few trades.

-

Foolish traders love the word ‘conviction’ and staying in a trade while smart traders trade change their positions quickly when proven wrong about a trade.

-

Foolish traders hang out with other fools on social media to create their own circle of ignorance the good traders and professionals hang out together as well.

-

Foolish traders subscribe to trading services because they are impressed with the pictures of luxury cars, yachts and mansions, those are not for subscribers they are what the trading ‘teacher’ buys with all the subscribers money.

-

Really foolish traders believe that some yahoo on twitter really never loses on any trade. They are the biggest fools of all.