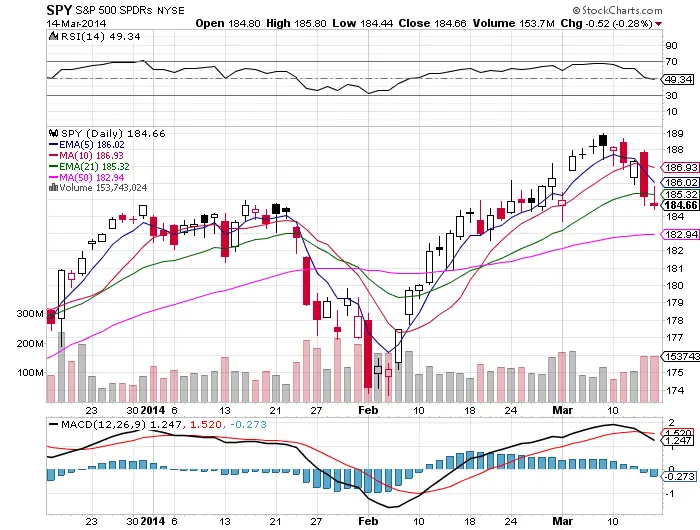

Last week was very choppy and sloppy and the market could hit a signal intra-day then move fast.

-

Equities as a whole are not under accumulation in 2014 so far they are only be traded in ranges as an asset class. $SPY and $SPX are still negative on the year but have provided plenty of trading opportunities. Small caps and tech stocks as a whole are only slightly positive on the year. This year is shaping up to be the year of the swing trader so far as the stock market buy and holders profits go back into the moth balls.

-

The long term equity uptrend has turned into a range bound market over the past 3 months.

-

Short term we are in a down trend, look for a reversal and break above the 5 day ema to change that.

-

We are far too extended from short term moving averages for any multi-day short trade at these levels, short plays will have better odds if they are opened shorting into rallies for short term trades.

-

The week before last on Friday after the non-farm payrolls $SPY hit the 70 RSI overbought signal intra-day and immediately sold off and that held as the short term top in the chart.

-

This Thursday we had the MACD bearish cross over intra-day and then a sell off ensued with in less than hours.

-

The 21 day ema added little support to stop the sell off which means the 50 day may be a high likelihood this week.

-

Plenty of headline risk coming out of Ukraine and Russia so we could see plenty of volatility, great place to be trading smaller than usual until a truly high probability set up emerges.

-

I would look to get long if we can get down near a 30 RSI intra-day level & bounce. That is a high probability long with a great risk/reward.

-

I would also look to get long if we can reverse and close above the 5 day ema and pivot off a bottom back over a previous days high as a show of strength. That would increase the odds of success for a long play by buying into strength.