-

Structure your position sizes and stop losses in trades so that if you are wrong you will not lose more than 1% of your trading capital on any one trade. Reducing your risk per trade to 2% of trading capital would be a huge improvement for many traders and if your account is big enough going down to half% of trading capital at risk would decrease stress dramatically.

-

Only trade in the markets, stocks, options, and futures you are very familiar with, learning while you lose money is very stressful.

-

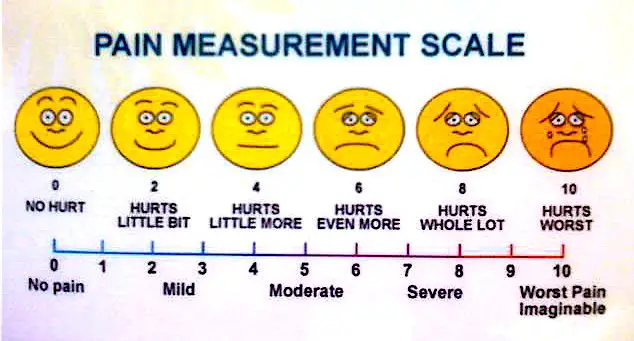

Know where you will get out of a trade before you get in. Know where the maximum pain and except it before you enter the trade.

-

Understand that the market determines whether you win or lose all you get to choose is your entry and exit. Accept that we have no control over the market moves.

-

Develop a faith in yourself as a trader based on your past trading and study.

-

After you have done your research have faith in your trading system as a winner then the belief that you have the ability to follow that system.

-

Be primarily a bull in a bull market and a bear in a bear market until the end when the trend bends.

-

Always trade with an edge on your side.

-

Take only the trades where the winning percentage or asymmetry is in your favor.

-

When there is no trade to take, then do nothing.