-

The long term stock market up trend from 2013 is still firmly in place.

-

The last two days moves in $SPY was a very strong bounce off an intra-day bottom at the 30 RSI.

-

A confirmation of a possible short term trend back up to all time highs would be a break and close above the 50 day simple moving average and over the 50 RSI.

-

If the 50 day sma and 50 RSI hold as resistance and are rejected it could lead to a short term trend to the 200 day sma in coming weeks.

-

The volume in the two day bounce was very healthy.

-

The $DIA index ETF had an almost picture perfect bounce off its 200 day sma last week. This is bullish.

-

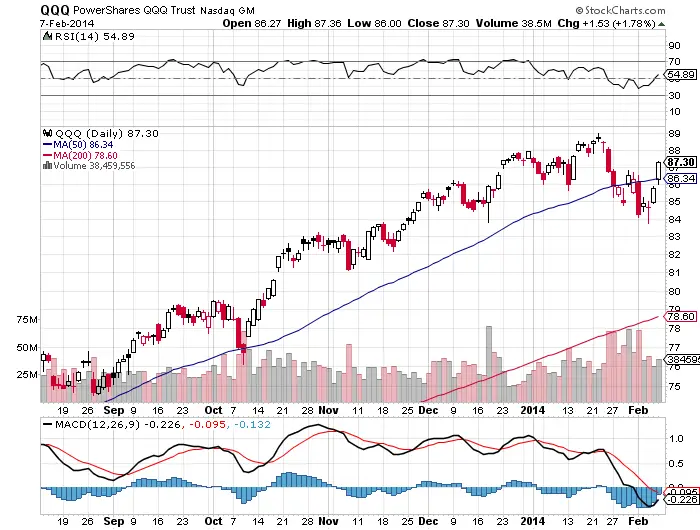

$QQQ broke and held above its 50 day sma last week. This is bullish.

-

$VXX chart reversed and fell sharply showing a perceived decrease in downside volatility risk. This is bullish.

-

The $SPY chart is in limbo here and can still be a fake out for the bulls.

-

My signals are long $SPY at the end of day above the 50 day sma for a longer term trade and looking at a quick short play if it is rejected and stays under the 50 day sma until the end of the day and also loses the 21 day ema.