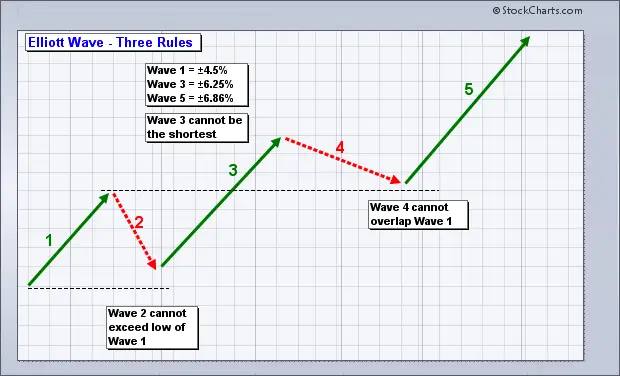

Chart courtesy of stockcharts.com

The Elliott Wave Principle is a from of technical analysis that some traders use to analyze financial market cycles and forecast market trends by identifying extremes in investor psychology, highs and lows in prices, and other collective factors. Ralph Nelson Elliott (1871–1948), a professional accountant, discovered the underlying social principles and developed the analytical tools in the 1930s. He proposed that market prices unfold in specific patterns, which practitioners today call Elliott waves, or simply waves. Elliott published his theory of market behavior in the book The Wave Principle in 1938, summarized it in a series of articles in Financial World magazine in 1939, and covered it most comprehensively in his final major work, Nature’s Laws: The Secret of the Universe in 1946. Elliott stated that “because man is subject to rhythmical procedure, calculations having to do with his activities can be projected far into the future with a justification and certainty heretofore unattainable.” The empirical validity of the Elliott Wave Principle remains the subject of debate. via Wikipedia

When most people hear about the school of Elliott Wave Trading, many are immediately dismissive of the theory. In large part, this is due to the stubbornness of Robert Prechter during one of his famous market calls. Prechter’s mistake was that he believed he had an infallible crystal ball, rather than going with the flow and reacting to price action. Most technical analysts, stock traders, and trend followers zone-out when talk of waves and ABC patterns arise, much like the general public does when traders discuss chart patterns, risk management, and trader psychology.

I have been more open to the convergence of Elliott wave patterns with traditional moving averages and chart patterns. Why? I have seen some Elliott wave traders utilize this method with great success. I have watched them trade in real time, over long periods, achieving fantastic results. If some of the best traders I know come from Elliott Wave City, then I have no choice but to go for a visit.

Here are four of the best Elliott Wave traders I have seen on twitter:

$/ES sold some more here @ 1786.00..will keep rest for Epic face rip potential

— DK1 (@canuck2usa) January 30, 2014

short ES 91 looking for 92 cash mini 23% retrace on presumed B wave. its like BTFD w/ monitor upside down :D. C up still likely 1800-15 spx — Ray C. Freeman (@R2RayCFreeman) January 30, 2014

SPX either built a 5th wave ending diagonal into close, or coiling for new downside ‘splosion. Sustained trade <1765 would suggest latter.

— Jason Haver (@PretzelLogic) January 30, 2014

My ES buy zone 1760-66; sell zone 1805-10 USD/JPY must remain above 101.75 otherwise my bullish bets are off — Mars Macro Trading (@Trader_Mars) January 29, 2014